Restructuring

Upside - Summer 2021

As lockdown measures have relaxed, HM Revenue and Customs (HMRC) has restarted debt collection activities with customers. It will initially focus on activities relating to collecting debts from customers who are least affected by COVID-19, those who are most able to pay their tax debts, taxpayers who have not responded to any correspondence or have not contacted HMRC to manage their account and arrears.

According to the London Gazette, there has been a negligible number of winding-up petitions lodged by HMRC this year, going back to March 2020. Therefore, it seems likely that once HMRC is free to start issuing winding-up petitions again, the numbers could rise sharply. HMRC is likely to be under some pressure to collect revenue for what is a much-depleted Exchequer. However, in light of the pandemic, enforcement of debt remains a political decision and could lead to further forbearance in certain instances.

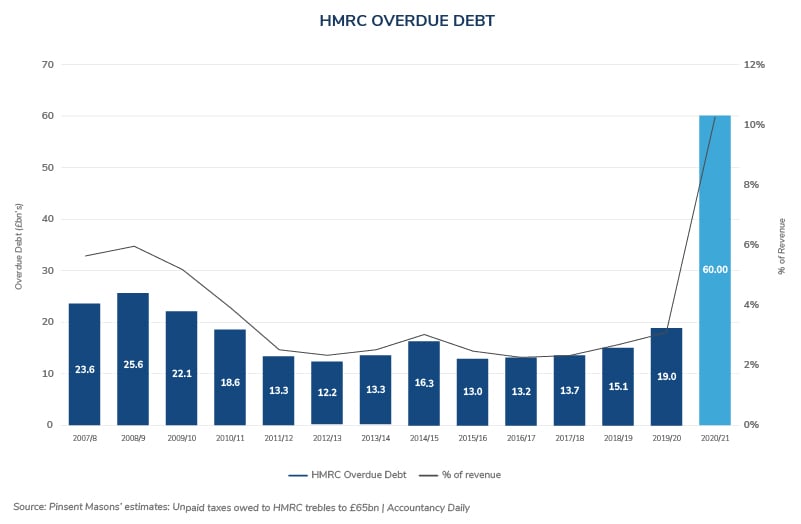

The graph below summarizes the levels of overdue debt and as a % of revenue since 2007:

Overdue debt after the financial crisis in 2008 was around £26bn. It has reduced significantly over the last 10 years and averaged at around £13bn. However, overdue HMRC debt crept up to £19bn in March 2020 (and this is partly due to COVID) and it is now expected to be around £60bn in March 2021. Since 2011/12, overdue debt stabilized at an average of £13.6bn and at between 2% and 3% of revenue and was easily expected to be around 10% of revenue in March 2021.

HMRC has stated that the overdue debt balance was impacted by the start of the COVID-19 lockdown and caused additional overdue debt of c £2.5 billion (which is included in the £19.0m overdue debt pile)1. HMRC fully expects there to be further substantial increases in the debt balance from 2020 to 2021 due to the ongoing economic impact of the pandemic.

Therefore, HMRC will be under pressure to ensure these debts are collected and the Time-to-Pay (TTP) scheme will play a key part in this. HMRC’s role as a preferential creditor in insolvency proceedings will also increase pressure for it to engage with businesses in a proactive manner.

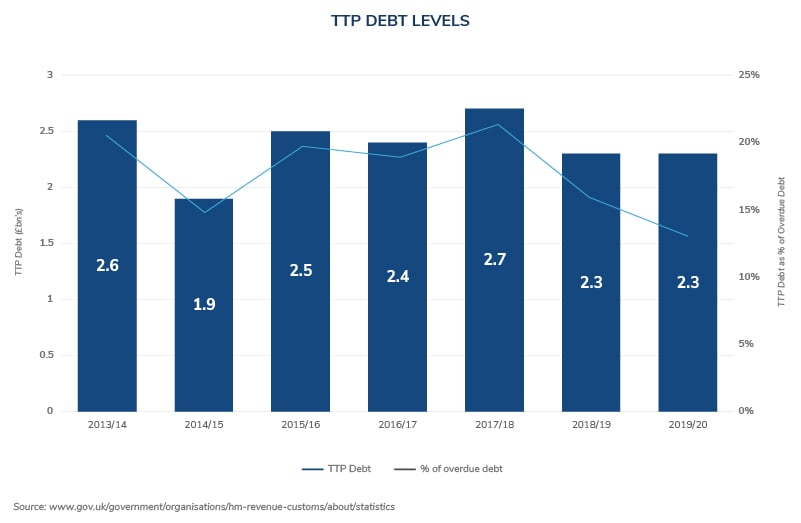

The chart below is a summary of the value of debts that were agreed under the TTP scheme by HMRC since 2013. From the end of 2019 to 2020, HMRC had £2.3 billion in TTP arrangements, supporting 648,000 taxpayers. HMRC is committed to being fair with debtors, which is reflected in the low level of complaints received, compared to the size of debt pursuit activity. From 2019 to 2020 it received 13% fewer complaints than the previous year.

It is fully expected that the TTP value for 2020/21 will be around the £8bn-£10bn level and this estimate is based on HMRC’s historic bandwidth (and appetite) to agree TTPs under the scheme. The key questions will center around how the enforcement of the estimated balance of c £50bn of overdue debt from March 2021 will be handled.

Although enforcement processes are expected to commence at the end of September 2021, HMRC announced in July that its Field Force Team (FFT) has started visits to businesses to assist in the collection of taxes. The FFT has special powers in repossessing goods and our Tax Arrears Solution (TAS) team can help businesses navigate through this legal process and negotiate payment plans with the FFT.

A total of approximately 27% of businesses that benefited from the Chancellor’s VAT deferral between March and June 2020 have failed to contact HMRC to pay the money they owe, even though the deadline to repay it or arrange a repayment plan expired on June 30, 2021. Approximately £2.7 billion remains outstanding which will be subject to enforcement action from September 2021.

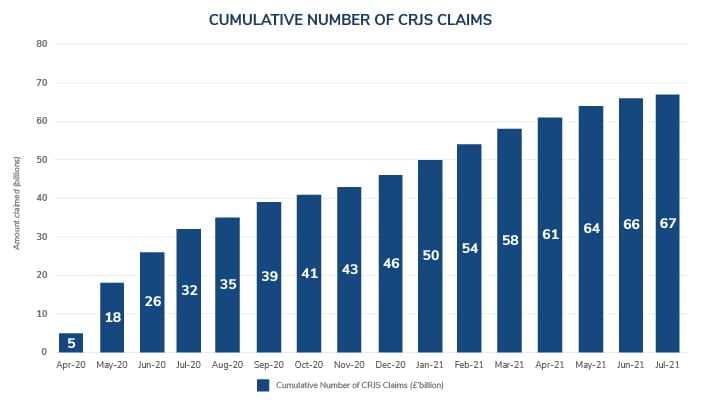

In addition to the deferred VAT, which remains outstanding, it is likely many businesses have failed to pay the associated pay as you earn (PAYE) and national insurance contribution (NIC) on the Coronavirus Job Retention Scheme (CJRS) claim of furloughed employees (the CJRS grant paid businesses the gross employee cost which includes the PAYE and NIC).

The below graph shows the cumulative CJRS cost to HM Treasury:

Kroll’s TAS team can help you or your client negotiate a Time-to-Pay (TTP) arrangement with HMRC, which is often a key component of a successful turnaround plan that preserves a company’s future and safeguards jobs. We use a hands-on approach to help clients facing financial uncertainties, working with management teams and their advisors to review working capital management and devise solutions to improve cash flow.

Since March 2020, our experts have secured over 70 TTP arrangements with a total debt value of £64m and saving over 10,000 jobs. Contact us today to find out how we can help you.

Source:

1 HMRC financial statements to March 2020 https://www.gov.uk/government/publications/hmrc-annual-report-and-accounts-2019-to-2020/summary-of-hmrcs-annual-report-and-accounts-2019-to-2020

Working with companies to stabilize cash flow and mitigate risk.

Supporting companies, lenders and investors take charge of complex situations under the toughest conditions.

by Martin Gray

by Rob Goodhew

by Greg Pollock, Eddie Bines