Strategy and Commercial Diligence

Kroll's Strategy and Commercial Diligence team provides strategic perspectives on the target’s market and competitive environment, as well as deeper insights and data on value creation opportunities.

How We Help

- Intellectually curious, combining core primary and secondary research skills with quantitative/financial analytical skills and strategic mindset

- Ability to draw upon broader sector expertise within Kroll and our external network of clients and relationships

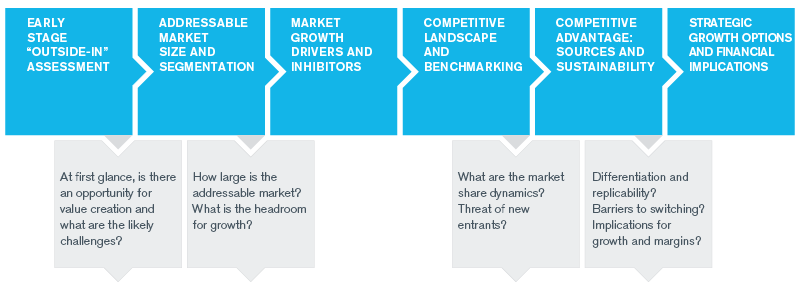

- Early stage “outside-in” research to provide initial insights into the attractiveness of a sector or specific target

- Detailed research and analysis to assess market size, addressable segments and growth prospects, often involving market modelling

- Interviews with clients, non-clients and competitors to form a robust view on competitive advantage—cost or differentiation based—and barriers to switching

- Benchmark and explain drivers of differential revenue growth and margins relative to market and competitors

- Provide insights and recommendations on strategy to enhance value

- Informed assessment and challenge of management’s revenue and margin forecasts

Comprehensive Due Diligence Solution

Our Comprehensive Due Diligence solution helps clients minimize risks and make the most informed business decisions. We support in the areas of tax, compliance and regulatory, ESG, operations/strategy, M&A, financial and accounting, investigations, disputes and cyber/IT risk.

Financial Due Diligence

Kroll's Financial Due Diligence team provides Quality of Earnings (QoE) and key financial analyses for buyers, sellers and banks in M&A transactions.

Operations Advisory Services

Operational process improvement to increase company value in Transactions, Expansion, and Turnaround.

Transaction Tax Advisory

Global tax services uniquely customized for asset managers.

IT Due Diligence

Dedicated IT due diligence team to minimize risk and optimize portfolio value of a company for M&A transactions.

Transaction Structuring and Accounting

Technical accounting expertise across the entire deal life cycle from designing deal structures during the diligence phase through to post deal integration and dispute services.