The S&P Healthcare Services Index decreased by 0.1% over the last month, compared to the S&P 500 Index, which decreased 4.6% over the same period.

Over the past month, the sectors that experienced the most growth were Behavioral Health (up 12.2%), Healthcare Staffing (up 8.7%) and Clinical Laboratories (up 6.5%). The sectors that experienced the largest declines were Healthcare Consulting (down 11.0%), Assisted/Independent Living (down 8.7%) and Acute Care Hospitals (down 8.2%).

The current average Last Twelve Months (LTM) revenue and LTM EBITDA multiples for the healthcare services industry overall are 1.79x and 10.6x, respectively.

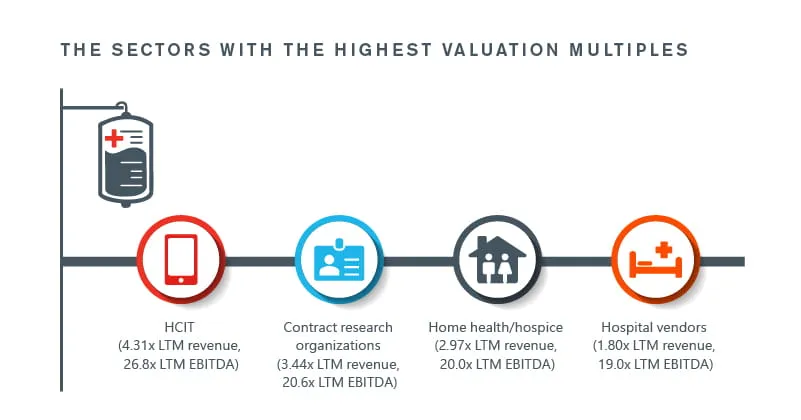

The sectors with the highest valuation multiples include:

- HCIT (4.31x LTM revenue, 26.8x LTM EBITDA)

- Contract research organizations (3.44x LTM revenue, 20.6x LTM EBITDA)

- Home health/hospice (2.97x LTM revenue, 20.0x LTM EBITDA)

- Hospital vendors (1.80x LTM revenue, 19.0x LTM EBITDA)