Duff & Phelps launched the 2020 U.S. Goodwill Impairment Study (the “2020 Study”), now in its 12th year of publication. The 2020 Study examines general and industry goodwill impairment (GWI) trends through December 2019 of over 8,800 publicly traded companies incorporated in the U.S.

Recognizing the significance of a recent global health event, this study also touches on the impact of the COVID-19 pandemic on goodwill impairments taken by U.S. based companies up to the time of writing. Times of crises and significant economic recessions always place an additional focus on impairments recorded by publicly traded companies.

Goodwill and impairment continue to be topics of interest to standard setters and stakeholders. Both the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) have current projects addressing goodwill and impairment. More developments in this area are expected to take place in 2021.

Highlights of the 2020 Study

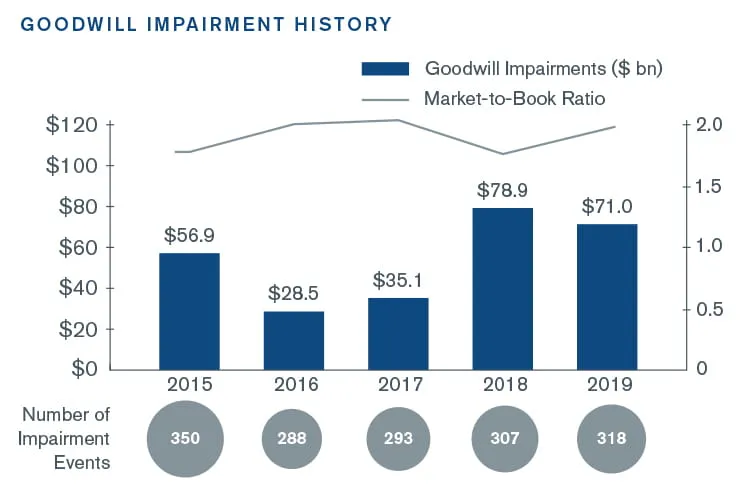

Total GWI recorded by U.S. public companies fell 10%, from $78.9 billion (bn) in 2018 to $71.0 bn in 2019, but this was still the second highest level since the 2008 global financial crisis.* Moreover, the 2018 aggregate GWI amount was significantly impacted by a single GWI event of $22.1 bn, recorded by General Electric (GE). If GE’s impairment event was excluded from the 2018 totals, aggregate GWI would have risen by 25% in 2019 (from $56.7 bn in 2018).

Additionally, the number of GWI events increased by 4%, from 307 in 2018 to 318 in 2019. The size of impairments has generally become larger, with the average GWI per event (excluding GE’s 2018 impairment) rising by 21% in 2019 to $223 million.

These elevated levels of GWI are broadly consistent with the global economic conditions experienced during 2018 and 2019. Trade tensions between the U.S. and its main trading partners (particularly China), combined with a Brexit impasse, created significant uncertainty among companies and global investors in late 2018 and early 2019. Most major economies saw growth decelerate in 2019, with U.S. real GDP moderating to 2.3%. Nevertheless, U.S. investors grew optimistic into 2019 and a “Phase 1” trade deal announced in October 2019 between the U.S. and China spurred new stock market record highs.

Industry Trends

In 2019, GWI increased or remained at similar levels in seven out of ten industries analyzed, with Industrials and Consumer Discretionary being notable exceptions. The industries with the largest increase in GWI over 2018, are as follows, in order of magnitude ($ in billions):

- Communication Services ($8.6 to $19.7)

- Information Technology ($2.7 to $8.1)

- Consumer Staples ($9.5 to $12.9)

Communication Services’ aggregate GWI amount more than doubled from 2018 to 2019, reaching its highest level since 2007. Traditional broadband, video and voice service providers were under pressure from new entrants (vertical integration and disrupting start-ups), as well as large providers that underwent M&A consolidation.

Consumer Staples reached a new record high in aggregate GWI since we began collecting statistics in 2005. Established companies are struggling with shifting consumer tastes and competition from new brands and/or lower prices. GWI in this industry has now increased for three consecutive years.

On the Horizon

Looking at 2020, COVID-19 was the biggest challenge faced by U.S. companies, as the related economic recession is now considered the most severe since World War II. Certain companies benefitted from stay-at-home and lockdown policies, while others struggled to survive without the physical presence of consumers. Even within the same industry, there was a marked divergence in performance, depending on the business model and how quickly a company was able to adapt to the new reality.

The 2020 Study gives a preview of GWI reported by U.S. public companies for calendar-year 2020 through January 28, 2021. For purposes of this article, we have updated similar metrics through February 28. Although full 2020 calendar year-end results will not be known for some time, early reporting points to overall GWI already exceeding $143 bn in 2020.

For perspective, in 2008, at the height of the global financial crisis, U.S. companies recorded a total GWI of $188 bn, according to our prior studies. Should the final 2020 aggregate GWI figures remain at a level lower than that in 2008, it will be partly a reflection of the unprecedented level of support provided by both the Federal Reserve and the U.S. government in response to the COVID-19 crisis. By a wide margin, the most impacted industry so far is Energy, a reflection of the collapse in global oil prices following the classification of COVID-19 as a pandemic.

*The 2020 Study only captures companies that are incorporated in the U.S. Therefore, certain companies that are incorporated outside of the U.S. are excluded from our analyses, even if they are viewed as U.S. companies by financial markets. If such companies were included, total GWI in 2019 would, at a minimum, increase by Schlumberger’s $8.8 bn impairment, leading to an aggregate $79.9 bn and thereby exceeding the 2018 GWI total amount.