- The total value of M&A, PE/VC investments and IPOs in Singapore exceeded US$100 billion, with a growth of over 15% compared to 2016, led by PE Buyouts. IPO capital raised in Singapore nearly doubled in 2017 over the prior year and is at a four-year high.

- Malaysia experienced the highest transaction value through M&A, PE/VC investment and IPO capital raised over the last five-year period.

- Indonesia sustained deal momentum and attracted significant technology investments.

In 2017, the region recorded total deal activity valued at over US$130 billion spread across 1,420 deals, with over 20 transactions valued at more than a billion dollars each. Globally, about 36,700 deals valued at over US$2.8 trillion were registered in the same period.

Singapore continues to have a lion’s share of the pie

Singapore recorded a total of 842 deals (M&A, PE/VC and IPOs) worth US$101.9 billion for 2017 as compared to 800 deals worth US$88.1 billion for 2016. M&A comprised the bulk of the deal volume in Singapore, constituting 698 deals valued at US$75.4 billion in 2017, compared to 684 deals valued at US$82.7 billion in 2016.

M&A deal values continued to be driven by sizeable outbound M&A transactions by Sovereign Wealth Funds (“SWF”), GIC and Temasek Holdings in consortium, complemented by other notable M&A deals such as Exxon Mobil Corp’s acquisition of InterOil Corp, Mitsui Sumitomo Insurance’s acquisition of First Capital Insurance Ltd, Mapletree Investments’ acquisition of US Student Housing Assets, and Mercatus Co-operative’s acquisition of Jurong Point Mall.

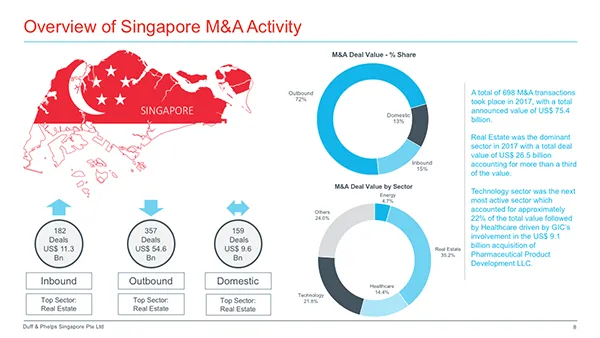

Outbound deals continue to drive Singapore’s M&A deal value

In 2017, there were a total of 539 cross-border M&A deals in Singapore registering US$65.9 billion. The bulk of total deal value came from 357 outbound transactions (Singapore-based companies or SWFs acquiring overseas companies) worth US$54.6 billion contributing to over 72% of the total deal value in 2017 for M&A deals. Domestic transactions contributed to 13% of total M&A deal value with 159 deals valued at US$9.6 billion.

The largest contributor to M&A deal values in Singapore was the Real Estate sector which has remained the top sector since 2016. Real Estate contributed approximately 35% to the deal values, while it also contributed the most to deal volume, accounting for 25.8% of the deal volume in Singapore with a total of 180 deals. Based on M&A deal values, the top 3 sectors (Real Estate, Technology and Healthcare) accounted for over 70% of total deal values.

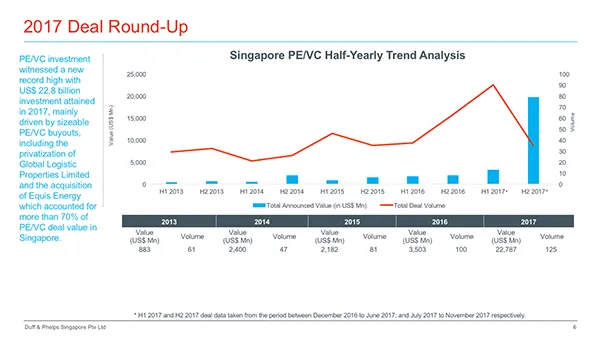

Highest yearly transacted value of PE/VC deals in Singapore in 2017

PE/VC investments in Singapore companies achieved record levels at US$22.8 billion in 2017 as compared to US$3.5 billion in 2016. This significant jump in value was attributable to some notable buyout / privatization deals such as the acquisition of Global Logistic Properties by China Vanke Co Ltd, Hopu Investment Management and other investors valued at US$11.6 billion; as well as Global Infrastructure Partners and other investors’ US$5.0 billion investment into Equis Energy.

Technology sector continues to be a key driver of PE/VC deals in the region

Over the past three years, the technology sector has been one of the largest contributors to PE/VC deals in the region. PE/VC investments into tech companies has grown by about 9 times from US$672 million in 2015 to US$5,892 million in 2017. During 2017, the top deals in the technology sector included the US$2.5 billion investment into Singapore-based Grab by Softbank Group Corp, Didi Chuxing and Toyota Tsusho Corp, and the US$1.2 billion investment into Indonesia-based Go-Jek by Tencent Holdings Ltd, JD.Com Inc and other consortium investors, reflecting positive investor interest in transport-related tech startups.

Four-year high in the Singapore IPO Market

The Singapore IPO market has witnessed a four-year high in value in 2017 with a total of 19 IPOs constituting US$3.7 billion raised on the Singapore Exchange, compared to 16 IPOs in 2016 raising US$1.9 billion. This strong performance in 2017 was mainly driven by the listing of Netlink NBN Trust which raised US$1.7 billion in IPO capital. Elsewhere, the Malaysia IPO market witnessed a significant growth in capital raised during 2017 with a total of 14 IPOs raising US$1.6 billion, compared to US$214 million for 2016.

Deal activity at a high in Malaysia and stable in Indonesia

Malaysia has seen a strong momentum in deal activity with total deals in M&A, PE/VC and IPO valued at US$20.3 billion in 2017 compared to US$15.6 billion in 2016. This is the highest deal value recorded in the last five years. Deal activity in Indonesia has maintained similar levels for 2017 with total deal values at US$ 9.6 billion, driven by sizeable transactions in the technology, materials and agriculture sectors.

“It is encouraging to see the transaction values in the region tower over the historic highs in 2015. We are witnessing the lines between the M&A and PE/VC investments blur and notice that several transactions could fall in either category, as strategic investors make minority investments and financial investors take controlling stakes,” said Ms. Srividya Gopalakrishnan, Managing Director, Duff & Phelps.

“This year, we have seen several positive trends including an increase in overall transaction activity, large buyout deals, considerable PE/VC investments into several sectors, significant investment in the technology sector and a notable recovery in the IPO markets. It is heartening to see a pick-up in energy sector transactions, a continued trend of Singapore companies acquiring global businesses, three IPOs back-to-back in the same year in the new economy sector from Singaporean companies and many more other reassuring developments. With the strong regional demographics, increased globalisation, impetus by government bodies to encourage investments, and increased focus on intellectual property, we see the positive deal momentum continuing into the future,” concluded Ms. Gopalakrishnan.

Media Coverage:

Television Media

- December 13, 2017 - CNBC, Squawk Box: Mergers and acquisitions slowed globally in 2017, but Malaysia was an exception

Print Media

-

December 13, 2017 - The Business Times, Dealmaking in key Asean economies at all-time high

-

December 13, 2017 - Lianhe Zaobao, 私募股权风险投资IPO与并购 今年总额增长15%达1377亿元

-

December 18, 2017 - The Straits Times, Dealmaking in region at a high this year

Online Media

-

December 12, 2017 - The Edge, Singapore's corporate deals, IPOs grow 15% to cross US$100 bil in 2017

-

December 12, 2017 - Bernama, Malaysia's M&A, PE/VC & IPO Deal Value Highest In Five Year: Duff & Phelps

-

December 13, 2017 - Nikkei Asian Review, Malaysia sees five-year high in deals in M&A, PE/VC and IPO

-

December 13, 2017 - Dealstreet Asia, SE Asia sees M&A, PE deal value touch record $130b in 2017

-

December 13, 2017 - The Edge Markets, 大马交易值创5年新高记录

-

December 13, 2017 - Singapore Law Watch, Dealmaking in Key Asean Economies At All-Time High

-

December 27, 2017 - Borneo Post Online, An eventful year for Malaysian corporate scene in 2017