Inside this Edition: Road Map for Ireland’s Tax Competitiveness Released.

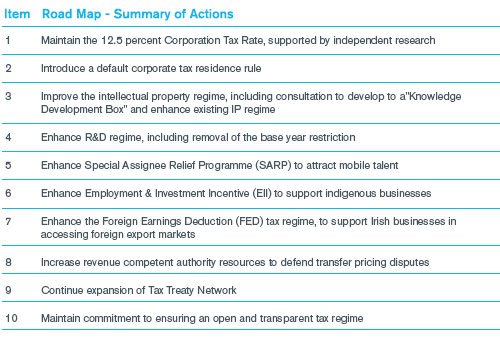

On October 14, 2014, Ireland’s Department of Finance released “A Road Map for Ireland’s Tax Competitiveness.” The publication seeks to outline a set of measures that will be undertaken to reposition Ireland to “be best able to reap the benefits, in terms of sustainable foreign direct investment, of a changed international landscape,” according to Michael Noonan, the Minister for Finance. There are ten essential elements to Ireland’s Road map of Tax Competitiveness, summarized below:

For more information please see full version of The Road Map for Ireland’s Tax Competitiveness click here.

States Team Up on Domestic Transfer Pricing Audits

The U.S. Multistate Tax Commission (MTC) Arm’s-Length Adjustment Service (ALAS) Advisory Group reconvened in Atlanta, Georgia in early October. The goal of the meeting was to continue to develop an inter-state transfer pricing system that will aid in identifying, analyzing, and correcting improper transfer pricing practices.

Specifically, the MTC invited seven third-party consulting firms to provide key recommendations in three areas:

- Perceived challenges in improving tax compliance related to intercompany transactions and methods for overcoming these obstacles;

- Types of transfer pricing services the advisors would be capable of providing to assist ALAS Advisory Group; and

- Recommendations on integrating transfer pricing work with local staff.

The third-party advisors collectively agreed that implementing a transfer pricing system improperly could prove to be costly and ineffective. The ALAS Advisory Group expressed considerable interest in how third-party advisors could provide resources and support to assist local staff in recognizing red flags for improper transfer pricing. Both parties seemed to reach a consensus regarding the utility of advisors in the event that a state auditor identifies a taxpayer with potentially improper transfer pricing. Under such circumstances, third-party advisors may be called upon to perform a detailed economic analysis or team with the state if the analysis moves to the litigation phase.

After hearing presentations from the third-party advisors, the ALAS Advisory Group met to discuss necessary next steps in implementing a transfer pricing system. While the takeaways from this follow-up meeting have not yet been made public, it is clear that MTC and the ALAS Advisory Group are serious about implementing a transfer pricing system that is valuable for its members.

So far, nine members have committed to the development of the Inter-State Transfer Pricing System: Alabama, Washington D.C., Florida, Georgia, Hawaii, Iowa, Kentucky, New Jersey, and North Carolina. The draft “Design for an MTC Arm’s-Length Adjustment Service”, which details the mission, timeline, steps, and resources necessary for implementing a transfer pricing system can be found here. Additional supporting documents pertaining to the ALAS Advisory Group’s October meeting can be found here.

New French Transfer Pricing Reporting Requirements

Background

On September 16, 2014 the Organization for Economic Cooperation and Development (OECD) released its first tranche of seven Base Erosion and Profit Shifting (BEPS) deliverables, including “Guidance on Transfer Pricing Documentation and Country-by-Country Reporting” which included an improved version of the ‘Country-by-Country Reporting Template’ (CBCRT). (See Transfer Pricing Times, Volume XI, Issue 8.)

On the same day, France released the final version of its new transfer pricing disclosure return, effectively aligning the French approach with that recommended by the OECD, while at the same time expanding France’s domestic reporting requirements beyond those of the OECD’s CBCRT.

The French filing requirements

The new French return consists of three spreadsheet-type forms covering:

- Group activities and intangible assets: broad descriptive information about the nature and ownership of group intangible assets used by the French reporting business;

- Income statement: descriptive and financial information in respect of intragroup trading transactions by amount, category of income or expenditure, and applied transfer pricing methodologies; and

- Balance sheet: descriptive and financial information in respect of intragroup asset transactions (intangible and tangible) by amount, category of acquisition or disposal, and applied transfer pricing methodologies.

These new measures apply to French entities with either sales revenues or gross assets of at least €400 million (approximately USD $540 million) in their own right, and also to French entities of any size controlled by foreign entities which themselves meet the €400 million threshold.

For forms 2. and 3., transactions only need to be reported if the aggregated amounts of all transactions per category exceed €100,000. For large businesses, these new transfer pricing reporting requirements are in addition to the comprehensive transfer pricing documentation requirements introduced in 2010.

The annual filing deadline is within six months of the due date for the business’s normal tax return. As a transitional measure, French businesses with tax return filing deadlines between June and November this year have until November 20 to file the transfer pricing return. For example, a business with a December 31, 2013 fiscal year-end must file its return by November 20, 2014.

Late-filing penalties are very modest at €150. However, further penalties of €15 can be applied for each additional error or omission, up to a maximum total of €10,000.

Implications

In terms of content, it is important to appreciate that the information required by the return is not purely domestic and will allow France to build a reasonable picture of many of a multinational group’s key intragroup transfer pricing flows, together with the nature and ownership of intangible assets, by country.

Critically, in today’s age of information exchange, it would be a mistake to believe that this information will remain in France; transfer pricing information received by France will be capable of being shared with other taxing jurisdictions under various international exchange of information provisions.

Recommendations

At the time of preparing the return, groups should assess the possible implications for non-French group entities. A recommended best practice will be for groups reporting in France under the new transfer pricing requirements to establish a centralized oversight process to collate and classify the information required, and to draft the return forms, in order to:

- Ensure accuracy, completeness, and consistency of presentation;

- Identify potential gaps and to assess risks and possible mitigating actions, as necessary; and

- Identify potential ‘touch points’ that could arise group-wide once the French tax authorities receive information and 1) ask their own questions, and 2) share it with other tax authorities.

EU Commission Investigates TP Practices of Member Countries

On September 30, 2014, the European Commission (EC) released its decision to open formal investigations into transfer pricing agreements entered into in Ireland, Luxembourg, and the Netherlands. This decision comes following three in-depth investigations, launched earlier this year examining whether decisions by tax authorities in these countries comply with the European Union’s rules on state aid with regards to corporate income tax.

The investigations pertain to whether or not the formal agreements, entered into by certain taxpayers and the Member States, follow the arm’s length standard set forth by the OECD’s Transfer Pricing Guidelines. The EC has specified key aspects considered relevant to the agreements under review, including the exclusion of a proper transfer pricing analysis; failure to explain a methodology applied; inability to adjust an agreement for future circumstances; and general departure from the arm’s length standard.

For more information related to the September meeting see the EU’s press release available here.

Stay Ahead with Kroll

Valuation Services

When companies require an objective and independent assessment of value, they look to Kroll.

Tax Services

Built upon the foundation of its renowned valuation business, Kroll's Tax Service practice follows a detailed and responsive approach to capturing value for clients.

Transfer Pricing

Kroll's team of internationally recognized transfer pricing advisors provide the technical expertise and industry experience necessary to ensure understandable, implementable and supportable results.

Valuation Services

When companies require an objective and independent assessment of value, they look to Kroll.