The S&P Healthcare Services Index increased by 6.5% over the last month, compared to the S&P 500 Index, which increased 1.1% over the same period.

Over the past month:

- The sectors that experienced the most growth were Telemedicine (up 33.3%), Consumer Directed Health/Wellness (up 18.1%) and Providers – Other (up 14.8%).

- The sectors that experienced the largest decline was Behavioral Health (down 7.9%), Care Management/TPA (down 4.5%) and Commercial Managed Care (down 3.9%).

- The current average Last Twelve Months (LTM) revenue and LTM EBITDA multiples for the healthcare services industry overall are 1.97x and 10.7x, respectively.

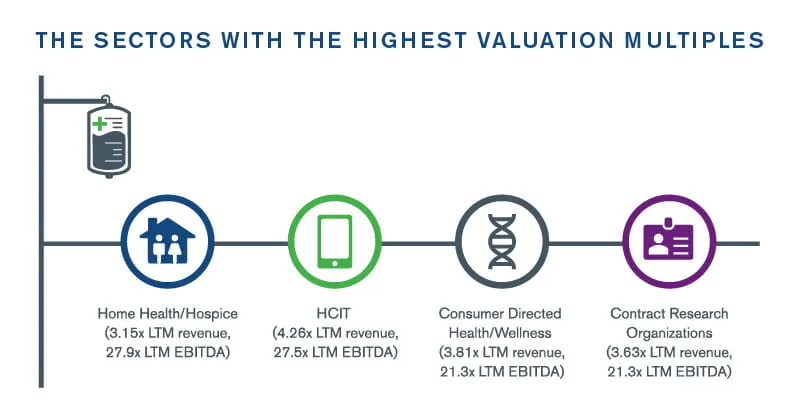

The sectors with the highest valuation multiples include:

- Home Health/Hospice (3.15x LTM revenue, 27.9x LTM EBITDA)

- HCIT (4.26x LTM revenue, 27.5x LTM EBITDA)

- Consumer Directed Health/Wellness (3.81x LTM revenue, 21.3x LTM EBITDA)

- Contract Research Organizations (3.63x LTM revenue, 21.3x LTM EBITDA)