IT Transaction Advisory Services

Kroll helps firms identify target’s technology risks, synergies and investment needs to support informed decision making in transactions

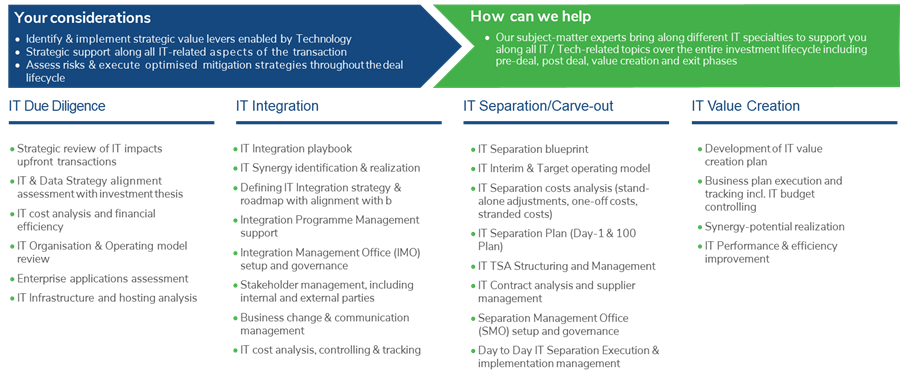

Our dedicated team helps clients assess and develop IT strategy and infrastructure, manage global customer relationship management (CRM) and enterprise resource planning (ERP) implementation/migration of business applications, and design custom software solutions to minimize risk and optimize the portfolio value of a company.

Our technology services cover IT buy-side due diligence, sell-side due diligence, infrastructure assessment, synergy analysis, CRM and ERP systems implementation, program management, security controls and potential data breach exposure, software code review, and managed IT services. We help our clients drive value while meeting their investment thesis and supporting corporate strategy throughout the deal’s continuum.

Stay Ahead with Kroll

Comprehensive Due Diligence Solutions

Our Comprehensive Due Diligence solutions help clients minimize risks and make the most informed business decisions. We support in the areas of tax, compliance and regulatory, operations/strategy, M&A, financial and accounting, investigations, disputes and cyber/IT risk.

Financial Due Diligence

Kroll's Financial Due Diligence team provides Quality of Earnings (QoE) and other key financial analyses for buyers, sellers, lenders and investment banks in M&A transactions.

Operational Strategy Advisory

Kroll advises on operational process improvement to increase efficiencies in transaction, expansion and turnaround situations that ultimately increase valuation.

Mergers and Acquisitions Tax Services

Kroll’s M&A tax practice brings deep experience executing thousands of transactions across industry verticals to deliver practical M&A tax solutions in partnership with our clients. Kroll understands M&A is often the cornerstone of value creation, and we tailor customizable and scalable solutions to enhance value across the transaction lifecycle.

Accounting Advisory

Kroll's specialist Accounting Advisory Team combines technical accounting expertise with practical, commercial deal experience to help clients manage the process of accounting and financial reporting for a transformational event.