Welcome to On the Move, the Duff & Phelps quarterly newsletter focused on current events in the Site Selection and Business Incentives Industry. With many state and local incentives available to corporations planning to create jobs, expand operations, construct new facilities or relocate entirely, On the Move will bring you the latest news about lucrative business incentive opportunities around the country.

With increased competition across the US to attract and retain business, many states are going head-to-head to prove why they are the best place to expand or relocate. Pro-growth states such as Texas, Wisconsin, Indiana, Michigan, Florida, Louisiana, Georgia, Tennessee, and Ohio are flourishing, and luring businesses away from their high-taxing counterparts. States with high taxes like California, Illinois, New York and New Jersey have explosive debt and considerably higher unemployment.

One of the biggest players in the fight to win or retain jobs is Texas. With its business-friendly reputation, zero state income tax, and an estimated $19 billion in tax breaks and other incentives being offered annually, Texas is working hard to lure businesses away from states like California which is home to a wealth of venture capital and technology-based companies, but is well known for high taxes and heavy regulation. Specifically, Texas has been targeting advanced manufacturing, digital media, data management, clean energy, and life science companies to grow job opportunity across the state. Major political change could come to Texas in November of this year; however, as the state will elect a new Governor who may not continue the business-friendly economic development policies.

Texas Eyes California-Based Businesses

Texas has made no apologies in its effort to win over California-based businesses. In fact, some of the biggest companies in the US have recently announced their intentions to call Texas home as part of expansion plans or relocation of operations, including:

- Occidental Petroleum – spinning off its California operations and relocating the company’s headquarters from Los Angeles, CA to Houston, TX.

- Charles Schwab – shifting approximately 1,000 San Francisco-based jobs to Texas and Colorado.

- Toyota – moving its US headquarters from Torrance, CA to Plano, TX along with 3,650 jobs.

- Channell Commercial Corporation – moving its headquarters and manufacturing operations from Temecula, CA into a new $20 million facility in Rockwall, TX.

- Raytheon – moving its Space and Airborne Systems headquarters from El Segundo, CA to McKinney, TX.

- Chevron – moving 800 members of its Bay Area staff to Houston, TX.

- State Farm – building a new campus for a regional hub on 186 acres in Richardson, TX.

- Amazon – building 3 fulfillment centers in Texas.

- LoanDepot.com, LLC – expanding operations to Plano, TX with plans to add more than 1,000 full-time jobs in the next 3 years.

Texas vs. California

With fewer regulatory burdens and a reformed legal system in place, Texas offers companies a very favorable business climate. In fact, the city of Houston was recently featured in the editorial pages of The Wall Street Journal for its economic turnaround and growth due to fewer regulations.

One factor companies consider when comparing locations is tax structure. California assesses corporate taxes based on the higher of 1) California corporate taxable income at 8.84%, 2) California corporate alternative minimum taxable income at 6.65%, 3) corporate franchise taxes or 4) a minimum franchise tax of $800. Texas imposes a gross margins tax instead of an income tax. Its gross margins tax is calculated on total revenue from its entire business less the greater of 1) $1M or 2) costs of goods sold or compensation paid. The gross margins tax rate is 1% for most entities (0.50% for qualifying wholesalers and retailers, and 0.575% for those entities with $10 million or less in total revenue). Note: Texas has included temporary permissive alternative rates for 2014 and a rate election for 2015 that are not reflected here.

California and Texas both impose sales taxes-California at a base rate of 7.5% (includes local jurisdictions) and Texas at a base rate of 6.75% to 8.25%, depending on the local jurisdiction rates. The base rates in both states may be increased by local transit or special district taxes, if enacted.

Other noted rankings and benefits that compare Texas and California include:

- The American Legislative Exchange Council (ALEC) ranks Texas #12 in economic outlook while California is much lower at #47.

- The Tax Foundation ranks Texas #11 for state business tax climate index, while California ranks #48.

- Texas does not collect personal income tax, while California has a personal income tax of up to 13.3%, the highest in the country.

- Texas is a right-to-work state; California is not.

- Fuel costs in Texas are $.70-$.80 cents per gallon lower than in California due to taxes and blending requirements.

- Electricity prices are about 50%-88% higher in California compared with Texas due to California’s renewable energy mandate.

On the Move provides a detailed review of available incentives and funding programs for both Texas and California below.

Key Texas State-Level Funds and Incentive Programs:

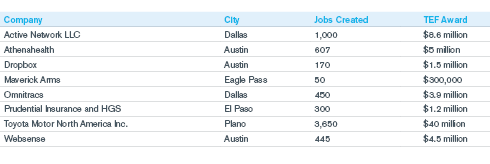

- The Texas Enterprise Fund (TEF) – A cash-grant relocation program established in 2003 to help attract new jobs and investment to the state. The TEF is the largest “deal-closing” fund of its kind in the nation and requires significant local support from the prospective Texas community.

- Texas Emerging Technology Fund (ETF) – Provides cash grants to expedite research, development, and commercialization of new technologies in Texas for select projects.

- Texas Skills Development Fund – Provides customized job training funds for businesses who want to train new employees or upgrade the skills of their existing workforce.

- Texas Enterprise Zone Program – Provides state sales and use tax refunds to qualified projects in economically distressed areas of the state.

- Manufacturing Exemptions – State sales and use tax exemptions on tangible property, natural gas, and electricity for manufacturers.

- Property Tax Value Limitation (Chapter 313) – A ten-year limitation of value on the school district maintenance and operations portion of property tax on new capital improvements.

- Freeport Exemptions – Property tax exemption for certain goods that enter and leave Texas within 175 days.

- Pollution Control Equipment Incentive – Property tax exemption for property that is for pollution control purposes.

- Renewable Energy Incentives – Property tax exemptions and deductions for solar, wind, ethanol, and biodiesel energy.

- Data Center Incentive – A temporary exemption from state sales and use tax on certain items necessary and essential to the operation of a qualified data center.

- R&D Tax Credit – A sales and use tax exemption and a franchise tax credit on research and development activities.

Key Texas Local-Level Funds and Incentive Programs

- Tax Increment Reinvestment Zone – Provides public financing for private infrastructure by allowing local governments to dedicate tax revenues created by the increase in property value within the zone to repayment of the improvements.

- Chapter 312 Property Tax Abatement – Provides for the abatement of up to 100% of ad valorem taxes on the increase in the value of real and/or personal property, for up to 10 years, by any city, county, and/or special district with jurisdiction over improvements within the reinvestment zone.

- Chapters 380 & 381 Economic Development Agreement – Provides municipalities (Ch. 380) and counties (Ch. 381) with the ability to offer loans, grants, rebates, in-kind services, etc. through city funds at little or no cost, to promote economic development and stimulate economic activity.

Texas Economic Incentive Package Spotlight: Toyota

Toyota evaluated more than 100 locations nationwide, but it was Plano, Texas that ranked highest in their site selection analysis which included an attractive incentive package. Plano rolled out the red carpet for Toyota with the largest economic incentive package in the city’s history. With the development of a 1 million-square foot campus, the transfer or creation of up to 3,650 jobs, and utilization of Plano hotels during the relocation period, the city offered a $6.75 million grant and a 10-year, 50% abatement on real and personal property taxes. Based on the $350 million value of the property, the tax abatement will cost the city $8.5 million over the decade. In addition to Plano’s incentive package, the state of Texas is contributing $40 million from the Texas Enterprise Fund. Details of the Plano City Council-approved package include:

- Toyota is eligible to receive $2.9 million if it completes the 1 million-square-foot building and creates or transfers at least 2,900 jobs by Dec. 31, 2017.

- Toyota can receive up to $900,000 for relocation expenses and be reimbursed up to $2.2 million for permitting, building, inspection and other fees.

- Toyota is eligible to receive a final grant of $750,000 if it adds 750 more full-time employees by Dec. 31, 2018.

- Toyota will receive 50% property tax abatement for 2018-2027 and a 50% tax rebate for the following 10 years.

Plano is already home to corporate headquarters such as JC Penney, FedEx Office and Pizza Hut and is hoping that Toyota’s successful relocation will attract other employers as well.

Key California State-Level Funds and Incentive Programs:

- California Competes Tax Credit – Income tax credit is available to selected companies planning relocations or expansions in the state (see Spotlight paragraph below for further information).

- New Employment Credit (NEC) – Income tax credit available to employers for taxable years beginning on or after January 1, 2014, and before January 1, 2021. A business must be located in a Designated Geographic Area (DGA) and hire qualified individuals satisfying at least one of the following five criteria prior to employment:

- Unemployed for the six months immediately preceding hire (twelve months preceding hire if just completed a degree or course of study)

- Veteran separated from the US Armed Forces in the preceding twelve months

- Recipient of the Earned Income Tax Credit in the previous taxable year

- Ex-offender convicted of a felony

- Current recipient of CalWORKS or general assistance

- Partial Sales and Use Tax Exemption – A partial exemption of sales and use tax on certain manufacturing, biotechnology, and research and development equipment purchases. The partial exemption applies only to the state sales and use tax rate portion, currently at 4.2%.

- Full Sales and Use Tax Exclusion – Advanced Manufacturing & Transportation and Alternative Energy – A sales tax exclusion from both state and local sales tax collection on equipment purchases for qualifying businesses that conduct qualifying activities. Sales tax rates vary by jurisdiction (typically 7.0% to 9.3%).

- California Research and Development Tax Credit – The state allows a 15% corporate income tax credit to companies with qualified research expenditures over a computed base amount.

- Employment Training Panel – A cash reimbursement for training costs incurred by employers, set by a pre-determined two-year performance-based contract, based on the number of employees enrolled, hours of training, training material and employee wages.

- Pollution Control Tax-Exempt Bond Financing – Private activity tax-exempt bond financing for the acquisition, construction, or installation of qualified pollution control, waste disposal, waste recovery facilities, and the acquisition and installation of new equipment.

Spotlight on California Competes Incentive Program

The California Competes Tax Credit is a non-refundable state income tax credit available to businesses intending to relocate to or expand in California. Any excess credit may be carried forward for 6 years and the credit is subject to recapture if terms of the negotiated agreement are not satisfied. The Governor’s Office of Business and Economic Development (GO-Biz) recently announced an increase in the California Competes tax credit program from $30 million to $150 million for the 2015 fiscal year. The large increase in available credits is due in part to the elimination of the Enterprise Zone program.

The California Competes tax credit is technically open to all companies with plans to expand or relocate to California. Small businesses (gross receipts, less returns and allowances, of less than $2 million) are encouraged to apply for the credit as 25% of the total credits available are specifically reserved for them. There are no limits to how many times a company can apply for the credit, but no single taxpayer can receive more than 20% of the amount of credit available per fiscal year.

The list of the 2014 winners shows a heavy concentration of high-tech, clean-tech and pharmaceutical manufacturers. A total of 396 companies requested over $500 million in credits but only $30 million was available. Award criteria are based on total jobs created, average wage, total investment, strategic importance, economic impact, and other factors. Below is a list of companies that received $1 million or more in tax credit through the California Competes program for fiscal year 2014.

California has authorized future funding as follows:

- $150 million in fiscal year 2014/15

- $200 million in each fiscal year 2015/16 through 2017/18

Economic incentives can be tremendously valuable for companies considering expansions or relocations, but the reality of the award process can be complicated and laborious.

Stay Ahead with Kroll

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Tax Services

Built upon the foundation of its renowned valuation business, Kroll's Tax Service practice follows a detailed and responsive approach to capturing value for clients.

Valuation Services

When companies require an objective and independent assessment of value, they look to Kroll.

Site Selection and Incentives Advisory

Kroll has a proven track record of assisting companies with location strategies in the U.S. and around the globe.