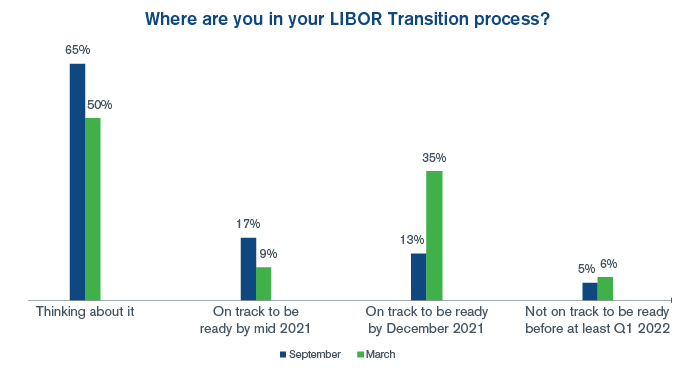

Kroll, recently conducted a survey that revealed that 50% of organizations still do not have a firm LIBOR transition plan in place. The survey follows a similar one carried out in September 2020, and the results show that the overall percentage of firms without a plan has improved from 65% in September, to 50% in March. The survey also revealed that the number of respondents with plans to complete their transition before the December 31 deadline also improved from 30% to 45%.

“The improvements are clearly welcome, but other responses in the survey revealed that over 50% of respondents from financial services firms had not set a date to cease new LIBOR linked issuance. In addition, 5% expected to be unable to meet the December 31 deadline which clearly shows there is much more work to do,” said Marcus Morton, Managing Director in the Valuation Advisory practice.

When asked where they were in the LIBOR transition process, 34% of financial institutions stated that they were on track to be ready by the end of 2021, while 14% said that they would not be ready until at least Q1 2022. This creates a wide array of where organizations stand in terms of when they will complete the transition away from LIBOR.

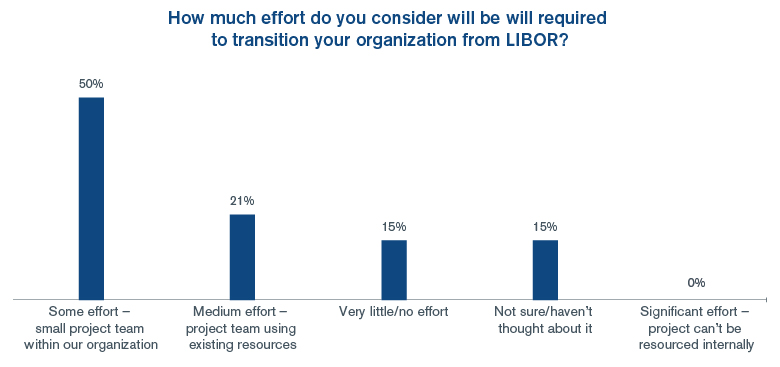

For non-financial institutions, when asked how much effort was being allocated towards the LIBOR transition, 50% indicated they expected their LIBOR transition would take some effort led by a small internal team, 21% indicated their expectation for a medium effort that could be handled with existing resources while 15% responded that they haven’t started thinking about the transition.

Stay Ahead with Kroll

Alternative Asset Advisory

Heightened regulatory concerns and vigilance, together with increased investor scrutiny, have led to increased demand for independent expert advice.

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Cyber and Data Resilience

Kroll merges elite security and data risk expertise with frontline intelligence from thousands of incident response, regulatory compliance, financial crime and due diligence engagements to make our clients more cyber resilient.