On October 13, 2022, the Australian Taxation Office (ATO) published three reports on the findings from the income tax assurance programs and information lodged by large corporate taxpayers. They cover: (i) the Top 100 program (ii) the Top 1,000 program and (iii) the Reportable Tax Position (RTP) schedule.

Top 100 taxpayers are identified based on the size of their Australian group operations among other factors, including the amount of direct and indirect taxes reported, and the influence the taxpayer may have on their market segment. Top 1,000 taxpayers are members of large public and multinational corporate groups with a group turnover greater than A$250 million (mn).

The RTP schedule, which is lodged with the company tax return, requires the largest public and multinational groups in Australia (those with total revenues of A$250 mn or more) to report uncertain tax positions (Category A) and material tax-related provisions (Category B) and disclose self-assessed risk ratings for specific arrangements of ATO concern covered by taxpayer alerts (TAs) and practical compliance guidelines (PCGs) (Category C). The ATO RTP report publishes the aggregated Category C disclosures (“disclosures”) made by companies for the 2017–18 to 2020–21 income years. This data provides useful insights about the prevalence of key tax risks and the spread of risk ratings in the RTP schedule population, and sheds light on where the ATO is likely to focus its compliance resources.

Some of the key findings and observations from the ATO report as they relate to transfer pricing are summarized below:

Top 100 and Top 1,000 programs

Related-party financing arrangements continue to be a key focus for the ATO. According to the ATO reports, 44% of taxpayers in the top 1,000 population subject to an assurance review had financing arrangements/transactions with the majority involving related-party arrangements. Financing arrangements had a higher amount of “red flag” assurance ratings (indicating likely non-compliance) and the lowest percentage of high-assurance outcomes compared to other areas reviewed. Of these, the most common transactions were interest-bearing loans, redeemable preference shares, cash pools, convertible notes and debt/equity characterization. For the top 100 population, related-party loans represent the highest proportion of dealings that attract a red flag rating, with over 15% of the related-party financing transactions reviewed attracting a red flag rating, with a further 13% attracting a “low assurance” rating (indicating more evidence/analysis is required to determine whether a tax risk is present).

Other than financing, issues relating to the inbound and outbound supply of tangible goods and services were the largest category reviewed within transfer pricing. Twenty-one percent of the top 1,000 taxpayers in this area obtained a low-assurance rating. For the top 100 population, related-party supplies of goods and services represents the third-highest proportion of dealings that attracted a red flag rating.

Another common area of concern identified by the ATO is the payment of license fees and royalties to international related parties, with a focus on whether sufficient benefit is being received by the Australian business to justify the payments of license fees and royalties.

RTP Schedule Disclosures

Perhaps, not surprisingly, the majority of PCG- and TA-related disclosures are related to transfer pricing. In particular, related-party finance arrangements (including derivatives) comprised about 70% of all disclosures in 2020-21. Other disclosures covered transfer pricing risks for inbound distribution arrangements (12%), centralized offshore marketing and procurement hubs (12%), the thin capitalization arm’s length debt test (2%), intangible assets (0.8%), offshore permanent establishments (0.4%) and mobile offshore drilling units (0.2%).

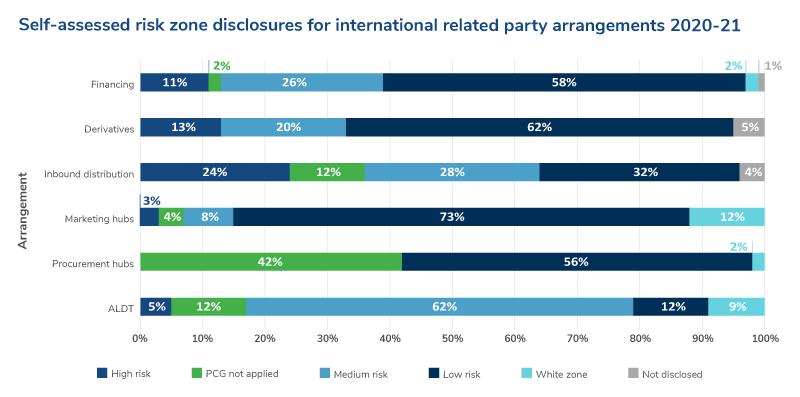

The spread of self-assessed risk ratings is summarized in the following chart:

While the RTP schedule report shows that the use of high-risk arrangements is not prevalent amongst large public and multinational businesses, it’s interesting to note that:

- 11% of disclosures on related-party financing arrangements in 2020-21 were assessed as falling in the high-risk zone

- 13% of disclosures on related-party financing derivatives in 2020-21 were assessed as high risk

- 24% of disclosures on inbound distribution arrangements in 2020-21 were assessed as high risk, based on the EBIT margin of these entities vs. ATO-published profit markers

This is not surprising, given the findings from the Top 100 and Top 1,000 assurance programs. Indeed, the ATO has indicated that the high-risk arrangements are or have been subject to review by the ATO.

What should you be doing?

RTP taxpayers with high-risk transfer pricing disclosures that are not already subject to an assurance review can expect to be investigated by the ATO. In particular, high-risk transactions involving cross-border related-party finance, distribution of physical and digital products, and intangibles will remain in the forefront of the ATO’s agenda and will likely be scrutinized.

Given that the ATO guidance applies to all taxpayers regardless of size, taxpayers need to understand how the risk-assessment criteria relate to their transfer pricing arrangements and their impact on tax outcomes, and they should work with their advisors to proactively manage their transfer pricing risks, including, potentially, taking remedial action to ensure the transactions are risk compliant. RTP taxpayers should ensure that they are well-prepared to address these transactions (and their risks) under audit.

Stay Ahead with Kroll

Valuation Services

When companies require an objective and independent assessment of value, they look to Kroll.

Transfer Pricing

Kroll's team of internationally recognized transfer pricing advisors provide the technical expertise and industry experience necessary to ensure understandable, implementable and supportable results.