The United States has always been one of the leading destinations for foreign direct investment. Our stable political climate, abundant natural resources, large workforce and trusted U.S. currency have historically been attractive for companies that are looking to establish or expand their presence in local and global economies. And now, there’s new area that makes the U.S. an extremely attractive place to do business, one that has presented challenges in the past—our tax code.

The U.S. tax landscape has changed dramatically since the signing of the 2017 Tax Cuts and Jobs Act (the “TCJA”). Until recently, the highest marginal federal corporate tax rate in the U.S. was 35 percent, which often surpassed 40 percent once state taxes were taken into account, putting U.S. companies at a distinct disadvantage when competing in the global market. The new tax law levels the playing field with the much lower 21 percent rate, while also closing several loopholes.

With all of the new provisions being introduced through the TCJA, site selection and economic developers would be wise to reconsider how to optimize their capital structures in this new environment. It impacts not only U.S. companies and their foreign operations, but also non-U.S. companies conducting business in the U.S. These companies will now be able to deduct 100 percent of certain capital expenditures through calendar year 2022, with a declining percentage thereafter. For example, a manufacturing company that purchases new machinery would be able to immediately write off its cost, and then further benefit from the lower 21 percent federal tax rate on profits earned from products generated by that equipment.

Without proper knowledge and a core set of tax strategies already in place, however, many companies may miss out on several of the lucrative incentives built in to the new tax reform. For companies that are repatriating capital to the U.S., we are recommending three main strategies to help maximize your value.

Strategy 1: Defer & Reduce Capital Gains

The TCJA created new incentives know as Qualified Opportunity Zones1, which allow the following:

- Taxpayers can defer the short-term or long-term capital gains tax due upon a sale or disposition of property if the capital gain portion of the sale or disposition is reinvested within 180 days in a “qualified opportunity fund.”

- If the investment is maintained in the “qualified opportunity fund” for 5 years, the taxpayer will receive a step-up in tax basis equal to 10 percent of the original gain.

- If the investment is maintained in the “qualified opportunity fund” for 7 years, the taxpayer will receive a 15 percent step-up in tax basis.

- A recognition event will occur on Dec. 31, 2026, in the amount of the lesser of 1.) the remaining deferred gain (accounting for earned basis step-ups) or 2.) the fair market value of the investment in the “qualified opportunity fund.”

The Qualified Opportunity Zones regulations are due in early summer. Until then, several working groups are predicting that the they will operate similarly to the New Market Tax Credit (NMTC) program, which attracts private capital into low-income communities by permitting investors to receive a tax credit against their federal income tax in exchange for making investments into a Community Development Enterprise. Here are a few other things to consider:

- In March and April, the Federal government designated low-income communities as a Qualified Opportunity Zones

- As of May 18, 2018, the Treasury approved more than 7,900 designated census tracts in 51 states, territories and D.C.

- A mapping tool is available on the Community Development Financial Institutions Fund (CDFI) website to help you confirm if you have assets located in Opportunity Zones.

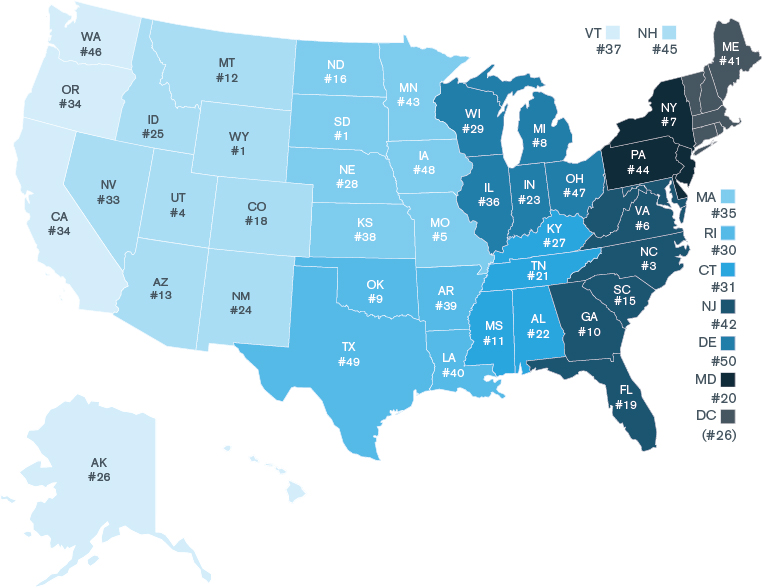

Strategy 2: Locate in a Low Tax State

You should look for low-tax states to help reduce overall effective tax rates. If investing in new facilities or consolidating older facilities, now is the time to select a location with low effective state and local tax rates. Find the most current list of rates here.

Strategy 3: Negotiate Long-Term Economic Development

If you are going to invest in a higher tax state, now is also a good time to negotiate long-term economic development incentives to lock in rate relief and lower your upfront costs. While most companies are aware of the impact that the public sector has on taxes, many often overlook the economic development incentives that can lower operating costs associated with things like utilities (electric, water, sewer) and state and local property taxes. Proper planning in this area can help offset up to 25% of capital costs. Also, cash grants and closing funds create abundant opportunities to help you lower your upfront costs.

Opportunity Triggers

There are certain factors that can serve as guidelines to help indicate when a project is ripe for taking advantage of these strategies, including:

- Capital Investment: $10 million

- Job Creation: 50 new jobs

- Average Wages: At or above county average wages

- But For: Negotiate incentives before committing or making a public announcement.

Case Study: Auto Supplier (Georgia)

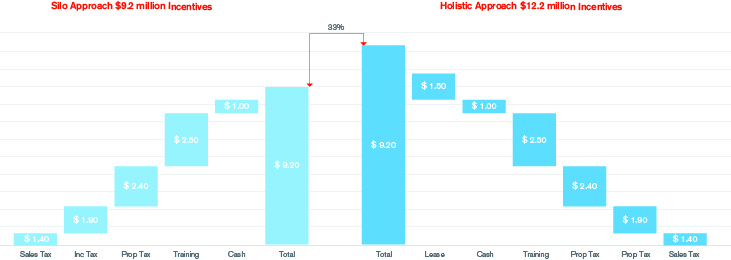

When negotiating incentives, it’s good to think creatively while utilizing a thorough, holistic approach. For example, in the case of an auto supplier client in Georgia, we were able to tap into a historically underutilized state tax abatement mechanism know as a “phantom bond” that grants property tax relief2 . The local community actually floated a bond and used the proceeds to construct a manufacturing facility and lease it to our client for below market rates.

- In Georgia, approximately 90% of all bonds-for-title transactions are used to provide tax incentives and do not represent true third-party financing arrangements.

- This type of transaction is referred to as a “phantom bond” or self-purchased bond transaction.

- The lessee pays the annual debt service per the lease agreement and receives the funds back as payment of debt service on the bonds.

- In some instances, the intent is to use the structure as “true” financing for the private project. In such a case, the bonds would be marketed and sold to one or more parties.

- The abatement structure leads to the creation of a leasehold estate, which in most instances is taxable.

- The company may negotiate with the local board of assessors to reach an agreement on the value of the leasehold interest.

- This is typical of transactions involving statutorily created authorities.

In other instances, the leasehold estate created may not be subject to taxation, which is true of some constitutionally created authorities. In such cases, the result is a 100% property tax abatement or agreements that result in payments in lieu of taxes (PILOT).

Our holistic approach to creating value helped generate 33% of additional value for this client (see charts below), and included:

- Property Tax Abatement

- Income Tax Credits

- Cash Grants

- Favorable Lease

Summary

For companies looking to expand, relocate, or consolidate operations, site selection can present significant value-add opportunities. Tax credits and incentives vary significantly from state to state, so knowledge of how to minimize state and local tax liabilities can be an extremely valuable asset in selecting sites for production, distribution, sales, back office functions, customer assistance, and more.

If executed effectively, site selection tax strategies can incentivize companies to reinvest into the economy through new capital investments or expansions, subsequently improving the financial environment for current employees while creating new jobs. We encourage our clients to look beyond what is available on state or local websites for creative tax structure values, and to dig deeper into the details of the state statutes and rates. That’s where you’ll find real value.

For more information on how site selection strategies can enhance the value of federal tax relief, contact the Duff & Phelps Site Selection and Incentives Advisory team.

Sources:

1 For a discussion of Qualified Opportunity Zones, please see James O. Lang and Justin J. Mayor, “Qualified Opportunity Zones and Tax Credit Incentives Under the Tax Cuts and Jobs Act”, GT Advisory (January 2018).

2 https://ggfoa.org/press-releases/development-authorities-as-financing-vehicles-in-georgia

Stay Ahead with Kroll

Valuation Services

When companies require an objective and independent assessment of value, they look to Kroll.

Tax Services

Built upon the foundation of its renowned valuation business, Kroll's Tax Service practice follows a detailed and responsive approach to capturing value for clients.

Site Selection and Incentives Advisory

Kroll has a proven track record of assisting companies with location strategies in the U.S. and around the globe.