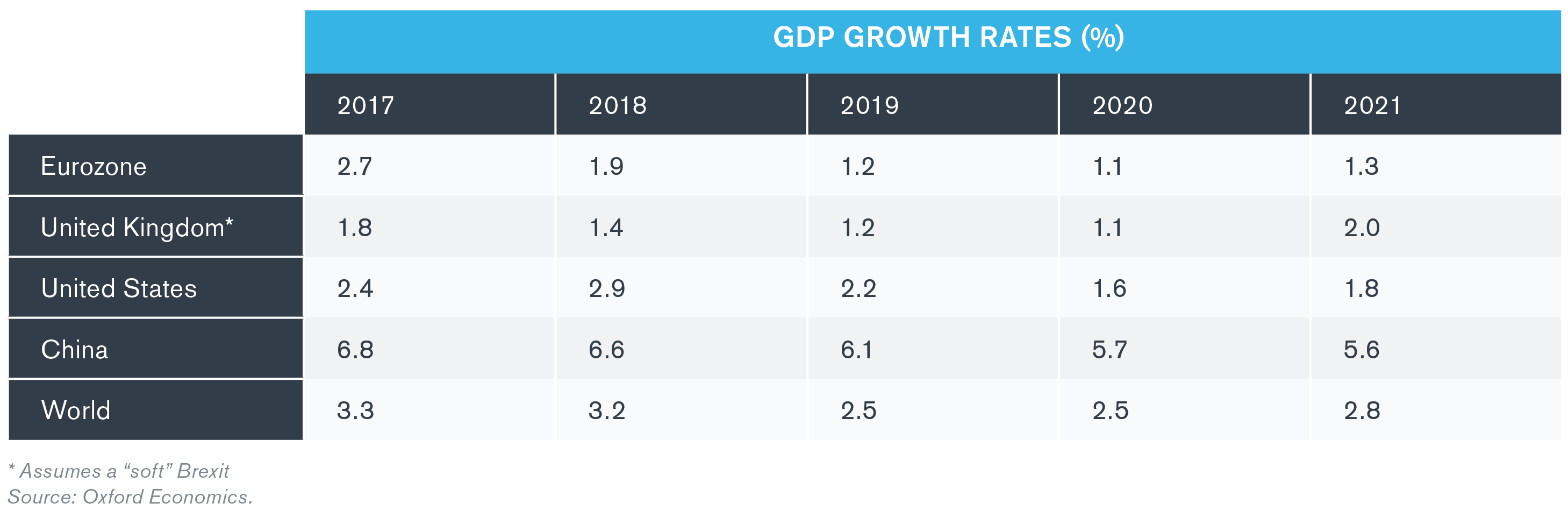

The outlook for the world and European economies has worsened over the last few months. World trade remains in the doldrums, industrial production is declining year on year in a large number of countries and geo-political uncertainties are mounting. A recession in the industrialized countries is possible though not yet inevitable. Forecast growth rates for 2020 and 2021 have, in any case, been reduced, especially in Europe.

Growth remains relatively solid in the world’s two largest economies, but alarm signals are appearing. Despite a relaxation in monetary policy, China is still going through a soft patch. Both investment and exports are subdued and even private consumption, the main engine of recent growth, appears to be slowing down. Trump’s protectionist moves and threats are clearly taking their toll on the economy. There may be occasional truces in the United States’ trade war, but the uncertainty that Trump has created weighs on expectations and hence on growth.

In the U.S., the labour market and some confidence indicators remain relatively strong, suggesting that moderate growth should continue, despite industrial weaknesses induced by low exports and investment. Fears of a recession hinge on the inversion of the so-called yield curve (denoting an unusual situation in which short-term interest rates are below long-term ones). In the past this has been an almost infallible sign of an impending downturn in activity. Yet the signal may be blurred on this occasion. There has been a global flight to safety which has pushed down returns on safe assets (such as U.S. Treasury Bonds). In addition, yields may also have come down because of mounting expectations of lower longer-run growth (or “secular stagnation”). In these circumstances, recession may not be as inevitable as some observers think. A slowdown to GDP growth rates not much above 1½ percent per annum, however, seems unavoidable.

The picture in emerging markets is mixed, but recent trends suggest that a number of countries are experiencing difficulties. This is particularly true in East Asia because of the sharp slowdown in the growth of world trade. In Latin America, Argentina is again in the throes of crisis, while Brazil and Mexico have to cope with new (and inexperienced) presidents. In both countries, growth has been almost flat this year. As for Venezuela, the economy seems now to be in virtual free fall.

The European situation has worsened over the summer. The continent’s biggest economy (Germany) is on the verge of recession with its industrial output declining now for more than a year. Despite calls from numerous quarters to use fiscal policy to boost demand, the country’s government still shows reluctance. The Italian situation is not much better. The change in government has produced a very welcome and hefty reduction in the interest rate spread between Germany and Italy, but this is unlikely, on its own, to spur a near lethargic domestic economy. While France and Spain are in a somewhat better position, Eurozone growth is very unlikely to be much above 1 percent both this year and next.

In addition, the threat of a so-called “hard” Brexit looms. An agreement between the UK and the EU is still possible between now and the end of October, but its chances are diminishing rapidly. Should it not be forthcoming, there will be economic costs for everyone. Oxford Economics estimates, for instance, that British GDP, rather than growing by 1 percent in 2020 and 2 percent in 2021, would marginally decline next year and rise by only 1½ percent in 2021. Ireland would also see its growth curtailed by 1¼ percentage points of GDP over the two years. Elsewhere the losses would be smaller, but all the four major Continental countries would lose at least 0.25 percent of their GDP in 2020.

A recession in the Eurozone might be avoided even in the case of a “hard” Brexit, but this outcome assumes that no other negative shocks would occur. Unfortunately, such shocks are possible. Two dangers, in particular, have emerged in the recent past. The World Trade Organization has authorized the U.S. to levy tariffs on European exports in retaliation for its subsidies to Airbus. In addition, Trump keeps threatening Europe with further trade duties. His latest targets are cars (mainly German) and wine (mainly French). Should he go ahead and should Europe retaliate (as it has promised to do), a fully fledged trade war would seem inevitable. Rough estimates suggest that such an outcome would reduce growth in the Euro area by ½ a percent in 2020 and by a full 1 percent in 2021. In addition, oil prices may also rise (as they did recently, albeit only temporarily) in the wake of continuing turmoil in the Middle East. Should a “hard” Brexit combine with Trump’s various tariffs and an oil shock, a recession would be inevitable. It might only be shallow (unlike 2009), but it could be protracted.

Economic policy would, in such a case, try to sustain activity, but there are limits to its effectiveness. Monetary policy has been further relaxed by the European Central Bank (ECB) at its last September meeting. Short-term interest rates are now projected to remain negative until, at least, the end of 2021. Yet the power such low rates have to stimulate growth has diminished through time. Mario Draghi, the ECB’s president, has acknowledged this and has called on Europe’s governments to do more on the fiscal policy front. Unfortunately, there is little consensus on this issue. France, Italy and Spain would almost certainly like to relax their fiscal stance, but all three are constrained by the Eurozone’s fiscal rules. Germany, which is not so constrained, is much more hesitant. Attitudes may change, of course. The Netherlands, for instance, is now planning to cut taxation and raise public investment expenditure despite its reputation as a country committed to austerity (and the new British government seems also willing to let its budget deficit rise), but a strong, pan-European, response still remains highly unlikely.

Hopefully, not all shocks will materialize (at least not simultaneously), but prospects both for the short- and the medium-run remain very subdued. Even if growth does not turn negative in 2020-21, the medium-term European outlook is for, at best, only very modest growth rates of output.

Duff & Phelps expressly disclaims any liability, of any type, including direct, indirect, incidental, special or consequential damages arising from or relating to the use of this material or any errors or omissions that may be contained herein.