The S&P Healthcare Services Index increased by 10.8% over the last month, compared to the S&P 500 Index, which increased 5.0% over the same period.

Over the past month, the sectors that experienced the most growth were acute care hospitals (up 29.6%), HCIT (up 20.7%) and healthcare staffing (up 20.1%). The sectors that experienced the largest declines were consumer directed health/wellness (down 3.9%), care management/TPA (down 1.6%) and assisted/independent living (down 1.4%).

The current average Last Twelve Months (LTM) revenue and LTM EBITDA multiples for the healthcare services industry overall are 1.84x and 10.2x, respectively.

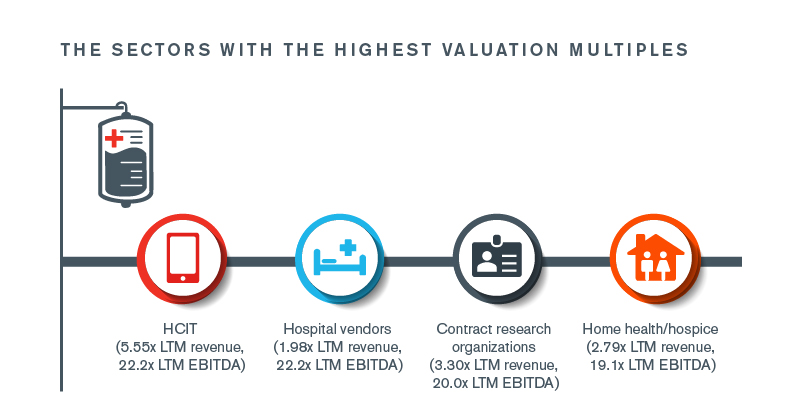

The sectors with the highest valuation multiples include:

- HCIT (5.55x LTM revenue, 22.2x LTM EBITDA)

- Hospital vendors (1.98x LTM revenue, 22.2x LTM EBITDA)

- Home health/hospice (2.79x LTM revenue, 19.1x LTM EBITDA)

- Contract research organizations (3.30x LTM revenue, 20.0x LTM EBITDA)

Stay Ahead with Kroll

Distressed M&A and Special Situations

Kroll professionals have advised hundreds of companies, investors and other stakeholders at all stages of distressed transactions and special situations.

Transaction Advisory Services

Kroll provides comprehensive due diligence, operational insights, and tax structuring support, assisting private equity firms and corporate clients throughout the deal lifecycle.

Transaction Opinions

Our Transaction Opinions solutions span fairness opinions, solvency opinions, ESOP/ERISA advisory, board and special committee advisory, and complex valuations.

Financial Sponsors Group

Dedicated coverage and access to M&A deal-flow for financial sponsors.

Debt Advisory

Kroll has extensive experience raising capital for middle-market companies to support a wide range of transactions.