The S&P Healthcare Services Index increased by 2.7% over the last month, compared to the S&P 500 Index, which increased 4.0% over the same period.

Over the past month:

- The sectors that experienced the most growth were Contract Research Organization (up 18.0%), Consumer Directed Health/Wellness (up 12.5%) and Behavioral Health (up 12.1%).

- The sectors that experienced the largest decline were Home Medical Equipment (down 8.3%), Skilled Nursing (down 7.8%) and Telemedicine (down 2.3%).

- The current average Last Twelve Months (LTM) revenue and LTM EBITDA multiples for the healthcare services industry overall are 3.71x and 14.8x, respectively.

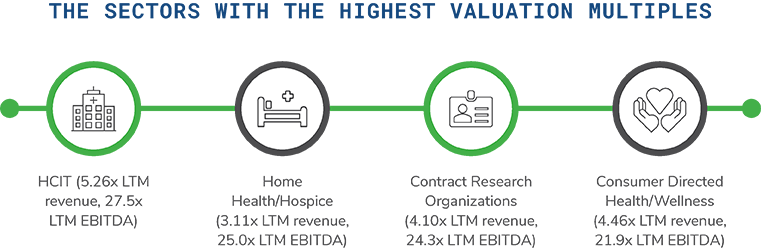

The sectors with the highest valuation multiples include:

- HCIT (5.26x LTM revenue, 27.5x LTM EBITDA)

- Home Health/Hospice (3.11x LTM revenue, 25.0x LTM EBITDA)

- Contract Research Organizations (4.10x LTM revenue, 24.3x LTM EBITDA)

- Consumer Directed Health/Wellness (4.46x LTM revenue, 21.9x LTM EBITDA)

Stay Ahead with Kroll

Mergers and Acquisitions (M&A) Advisory

Kroll’s top ranked M&A Advisory practice spans sell-side, buy-side, due diligence, deal strategy and structuring, and capital raising.