A salient feature of today’s risk landscape is the variety of risks that can emanate from business networks. Respondents in the United Kingdom are acutely aware of this type of threat, with 42 percent–a larger share than in any other country– having suffered reputational damage due to third-party relationships (vs. 29 percent globally). Similarly, UK respondents are more likely than average to hold third parties, such as business partners and suppliers, responsible for incidents generally (25 percent vs. 19 percent globally). To that end, UK respondents are more likely than average to practice reputational due diligence on the full range of stakeholders, from board candidates (98 percent vs. 91 percent globally) to social media influencers (89 percent vs. 85 percent globally).

UK organizations have also been hard-hit by internal fraud; with 38 percent of its organizations so reporting, the United Kingdom trails only sub-Saharan Africa (44 percent). As UK organizations seek to address this issue, they may wish to examine the extent to which their company culture reinforces transparency and accountability. For several corporate behaviors that support such a culture, UK responses are in line with global averages, but they reveal a lag in two key areas: Only 70 percent agree there is a clear message from the top of their organizations that integrity, compliance and accountability are important (vs. 78 percent globally), and the same percentage says that employees view risk management processes as being effective (vs. 76 percent globally). That 20 percent of incidents were reported by whistleblowers–a rate 7 percentage points higher than the global average–may also necessitate more work on reinforcing key cultural norms, as whistleblowing often reflects low confidence in traditional remediation channels.

Geopolitical tensions are high on the agenda, with 60 percent of UK respondents reporting that they have been affected by changes in economic treaties between countries (vs. 51 percent globally). Looking ahead to future risks, UK respondents are likely to be concerned about a breakdown of intergovernmental mechanisms for dispute resolution, free trade and combating corruption (60 percent, in line with the global average), but they are even more likely to be concerned about disruptions caused by artificial intelligence or other technologies (68 percent vs. 56 percent globally). These respondents may be highly aware of AI’s possibilities–for good or ill–due to the UK government’s recent push to strengthen the country’s AI capabilities.

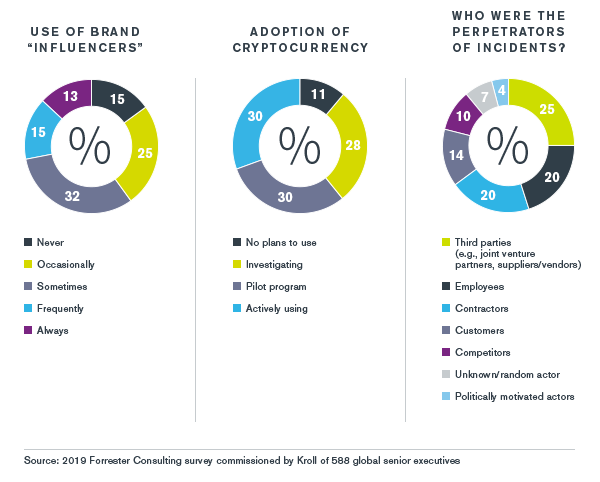

UK organizations have widely adopted social media influencers: A mere 15 percent of respondents report their organizations never use them (vs. 22 percent globally). Current discussions about disclosing payments to influencers may have an impact on this trend. UK respondents are similarly amenable to cryptocurrency, with only 11 percent of surveyed firms saying they have no plans to use digital assets (vs. 19 percent globally).