Financial services is one of the most regulated of all sectors, a characteristic borne out by the industry’s risk profile. Responses to our survey indicate a lower rate of bribery and corruption than any other industry (13 percent vs. 23 percent for all industries) and a likelihood of money laundering that is only slightly above average despite the industry’s considerable inherent risk in this area (18 percent vs. 16 percent for all industries). Not surprisingly, given financial services’ regulatory framework, those organizations are more likely than others to prioritize the mitigation of money laundering (73 percent vs. 62 percent for all industries).

In recent years, as the financial services industry has expanded its online presence, it has accordingly adopted a higher social media profile, thereby encountering new risks. For example, skeptical consumers can be quick to respond to actual or perceived missteps—and our survey reveals that, indeed, financial services is more likely than average to have experienced significant adversarial social media activity (35 percent vs. 27 percent for all industries). Ironically, it is also the industry least likely to make a priority of countering negative social media activity (56 percent vs. 63 percent for all industries), which indicates a clear opportunity for improved risk management in this area.

The survey results also point to two aspects of incident detection that warrant attention. First, financial services firms are less likely than those in any other industry to believe that their cybersecurity is effective at detecting incidents (73 percent vs. 81 percent for all industries). This sentiment likely stems from the high-profile cyber incidents that have recently affected the industry and from the awareness that the industry’s very nature makes it a perennial high-value target.

In addition, respondents in the financial services industry are less likely than those in any industry besides professional services to hold that their whistleblowing program offers effective incident detection (60 percent vs. 66 percent for all industries). In line with this finding, a lower percentage of incidents are detected by internal whistleblowing programs in financial services than in any other industry (10 percent vs. 13 percent for all industries). Financial services organizations may need to strengthen their whistleblowing programs, particularly in light of regulation in several countries that increases whistleblowing protection.

Financial services organizations are less likely than average to have been affected by geopolitical risks—with the notable exception of restrictions on foreign investment, which have affected the financial services industry more than any other due to its role as an investment intermediary (55 percent vs. 47 percent for all industries).

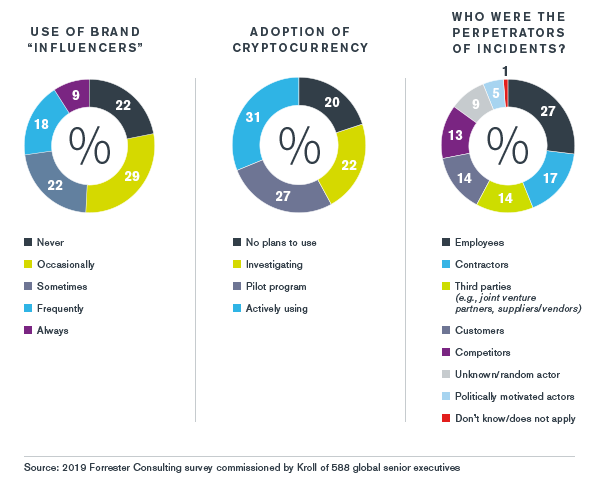

Looking ahead five years, the financial services industry is less concerned than any other industry about either military conflict (38 percent vs. 51 percent for all industries) or climate change (47 percent vs. 54 percent for all industries). Most notably, financial services expresses the least concern of all industries regarding possible destabilization of fiat currency due to cryptocurrency (38 percent vs. 53 percent for all industries)—a finding that may pave the way for increased acceptance of these digital assets.