Top Line Findings

- Almost two thirds (64%) of respondents say the current regulatory regime is effective in preventing financial crime

- But 33% say they spend more than 5% of annual budgets on compliance

- New York (56%) surges ahead of London (34%) as world’s preeminent financial center

- But 30% say UK has the most favorable regulatory regime for financial services, ahead of New York (26%) and Singapore (18%)

- The war for talent (24%) and cost of compliance (20%) biggest challenges facing financial businesses

- Almost half (47%) say investor demand will drive environmental responsibility in the financial sector, against 25% for regulation

Introduction

Study the natural landscape for any amount of time and you quickly become aware of the range of powers that have shaped it. From seismic action to gradual erosion and the daily wear of wind, waves and rain -- It is layer upon layer of never-ending change. And we never know for sure when the flood waters might come.

As it is with nature, so it is with regulatory environment. Each year, as part of its Global Regulatory Outlook, Kroll conducts an online survey of financial services executives around the world to get their views on issues that are shaping and changing the industry.

This year’s outlook report reveals a landscape that is the product of historic failures, but also continued innovation and challenges. And it changes still.

At Peace With the World

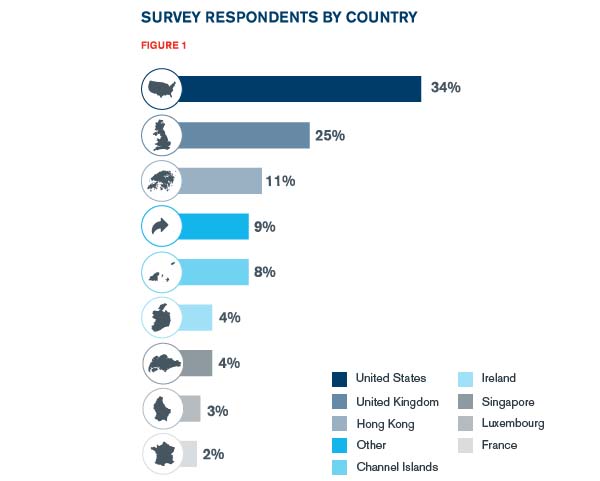

We surveyed 240 senior executives working in financial services across banking, asset management, hedge funds, private equity, broker dealers and a range of other business. They come from the U.S., UK, Asia and a number of other jurisdictions. Seven out of ten work for organizations with operations in more than one country.

Overall, our findings suggest a level of acceptance of the current regulatory regime. Close to two-thirds say that the current regime is effective in preventing financial crime (64%), for example—at least when it comes to their own territory. Even though fewer (34%) are willing to vouch that it is effective on a global level, this is a vote of confidence, and all the more remarkable given that, as we’ll see, they are not blind to regulations’ faults.

Moreover, those territories named as having the most favorable regulatory regimes—notably the UK (30%) and U.S. (26%)—are among the most mature. There is also a strong home bias: executives were most likely to name their domestic jurisdiction as having the most favorable regime.

On these findings, those surveyed would seem relatively satisfied with the current regulatory regime.

Stay Ahead with Kroll

Financial Services Compliance and Regulation

In the ever-evolving financial services landscape, Kroll's award-winning team offers comprehensive regulatory and compliance services, guiding clients through registration, licensing, and compliance support to minimize risks and enhance efficiency globally.

Regulatory Advisory and Assurance Services

In an era of increasing regulatory scrutiny, Kroll stands as a premier provider of Regulatory Advisory and Assurance Services to the financial services industry. Our award-winning team helps clients navigate complex regulatory landscapes, offering tailored solutions from governance and risk management to financial crime prevention and investment compliance.

Forensic Investigations and Monitorships

The Kroll Investigations, Diligence and Compliance team consists of experts in forensic investigations and intelligence, delivering actionable data and insights that help clients worldwide make critical decisions and mitigate risk.

Cyber and Data Resilience

Kroll merges elite security and data risk expertise with frontline intelligence from thousands of incident response, regulatory compliance, financial crime and due diligence engagements to make our clients more cyber resilient.