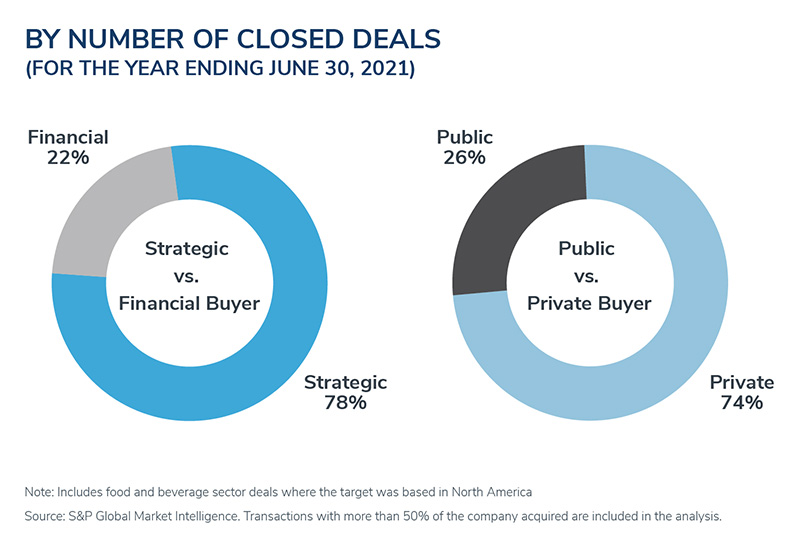

Food and beverage M&A deal activity in the U.S. and Canada has surpassed pre-COVID levels in the second quarter of 2021, with 369 deals closing over the trailing-12-month (TTM) period, ending June 30, 2021. Transaction volumes in Q2 2021 were drastically above the previous year, with 99 deals announced, in comparison to 56 – recall that M&A activity was severely impacted in the second quarter of 2020 by the fallout from the initial COVID-19 lockdowns. Q2 2021 was tied for the strongest quarter since 2015, in terms of number of deals for the food and beverage space.

M&A activity will likely accelerate within the next year, with an abundance of cash on the balance sheets of strategic buyers and financial sponsors and interest rates remaining at record lows. Additionally, companies that have experienced financial hardship in the last year and a half are likely looking to consolidate or seeking capital to build back. Coming off historic deal volumes in Q2, we anticipate continued momentum in food and beverage M&A for the remainder of 2021.

Connect With Us

Stay Ahead with Kroll

Consumer, Food, Restaurant and Retail Investment Banking

Consumer, Food, Restaurant and Retail expertise for middle-market M&A transactions.

Distressed M&A and Special Situations

Kroll professionals have advised hundreds of companies, investors and other stakeholders at all stages of distressed transactions and special situations.

Transaction Advisory Services

Kroll’s Transaction Advisory Services platform offers corporate and financial investors with deep accounting and technical expertise, commercial knowledge, industry insight and seamless analytical services throughout the deal continuum.

Transaction Opinions

Our Transaction Opinions solutions span fairness opinions, solvency opinions, ESOP/ERISA advisory, board and special committee advisory, and complex valuations.

Debt Advisory

Kroll has extensive experience raising capital for middle-market companies to support a wide range of transactions.

Financial Sponsors Group

Dedicated coverage and access to M&A deal-flow for financial sponsors.