Mark Kwilosz

AT A GLANCE

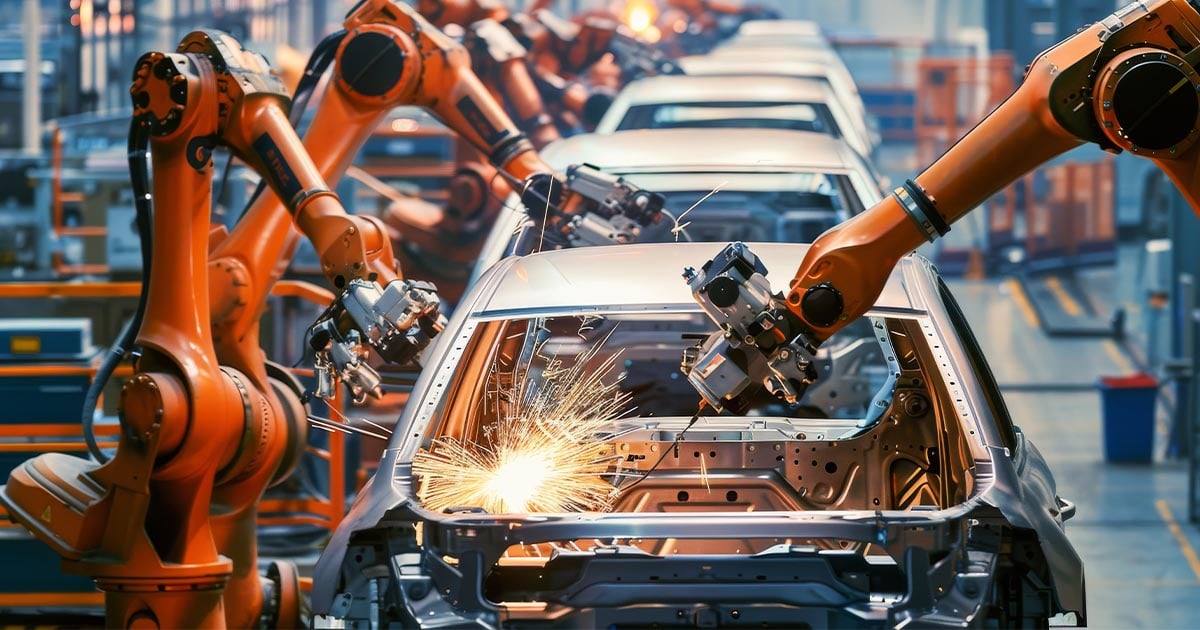

Mark has provided M&A and debt advisory services, fairness opinions, solvency opinions, valuations and other corporate finance advisory services to clients involved in a variety of transactions, including leveraged buyouts, related-party transactions, recapitalizations, spin-offs, going-private transactions, rights offerings, share repurchases, and ESOP transactions. His advisory experience is primarily focused in the industrial sector with significant additional experience in technology, consumer products and financial services sectors.

Mark's clients span a broad range of corporations and private equity groups, including Atlas Crest Investment Corp. (Archer Aviation), CITIC Capital Acquisition Corp. (Quanergy Systems), Holley, Santa Cruz Nutritionals, Blackbaud, Visteon, Lear Corporation, General Motors (VEBA), Toyota, Johnson Controls, Adient, Clarios, NN, Takata, National Machinery, AT&T, Windstream, Verizon, Time Warner Cable, CDW, Masco, Fortune Brands, Masonite, Boise Cascade, Ingersoll-Rand, Citadel, and Hellman & Friedman.

Mark’s publications include “Should Microcap Companies Go Private?”, Kroll’s “Millennials and Auto Trends Report” and Kroll’s recurring newsletter “Automotive Industry Insights”. Mark has also been a guest speaker at Northwestern’s Kellogg School of Management, the University of Illinois’ Gies School of Business and DePaul’s Driehaus College of Business.

Prior to joining the firm, Mark was an engineering manager with Illinois Tool Works Inc. (ITW), where he was responsible for managing the design and manufacture of components for the automotive industry. While at ITW, he was granted seven U.S. patents for his inventions.

Mark received his M.B.A. in finance, strategy and entrepreneurship from Northwestern University's Kellogg School of Management and his B.S. in mechanical engineering from the University of Illinois. He is a Financial Industry Regulatory Authority (FINRA) registered representative, holding the FINRA Series 7 and 63 licenses, and a CFA Charterholder. He is also a member of the CFA Society of Chicago.

Kroll Named 2025 Global Leader in Fairness Opinions

Kroll continues to set the standard among independent financial advisors with its market-leading Transaction Opinions practice. Over the 20 years that the team has maintained its leadership position, Kroll has rendered over 1,500 fairness opinions worldwide, covering transactions with an aggregate deal value exceeding $1 trillion.

Stay Ahead with Kroll

Transaction Opinions

Our Transaction Opinions solutions span fairness opinions, solvency opinions, ESOP/ERISA advisory, board and special committee advisory, and complex valuations.

Fairness Opinions

Our Opinions practice is a global leader in Fairness Opinions and Special Committee Advisory, ranking #1 for total number of fairness opinions globally in 2025 and over the last 20 years according to LSEG (fka Refinitiv).

Solvency Opinions

Kroll’s Opinions practice is a globally recognized leader in solvency opinions. Over the last 20 years, we have rendered more than 1,400 solvency opinions with $10+ trillion in deal value.

ESOP and ERISA Advisory

Kroll's ESOP/ERISA practice is a leading corporate finance and valuation advisor to companies and ERISA fiduciaries.

Navigating Global M&A with Regulatory Precision

When a multinational company pursued a strategic acquisition across borders, they faced a maze of regulatory valuation requirements. Kroll stepped in to guide the process, ensuring compliance and clarity every step of the way.