AT A GLANCE

Prior to joining the firm, Steve was a vice president at Harris Bank and provided corporate banking and advisory services to middle-market companies.

In addition to his mergers and acquisition advisory experience, Steve provides private placement and financial restructuring services to private and public companies. He has worked across multiple industries within the industrials sector, including building products, motor and gears, plastics and specialty chemicals and HVAC products and equipment. His accomplishments include executing the sale of more than 100 middle-market companies and raising more than $1 billion in capital for client companies. Steve has also spoken on a wide variety of topics related to the investment banking environment.

Steve received his MBA in finance from DePaul University and his B.S. in finance from Indiana University. He serves on the board of directors of Regal Beloit Corporation (NYSE: RBC), as well as the finance advisory board in the Driehaus College of Business at DePaul University.

Stay Ahead with Kroll

Mergers and Acquisitions (M&A) Advisory

Kroll’s top ranked M&A Advisory practice spans sell-side, buy-side, due diligence, deal strategy and structuring, and capital raising.

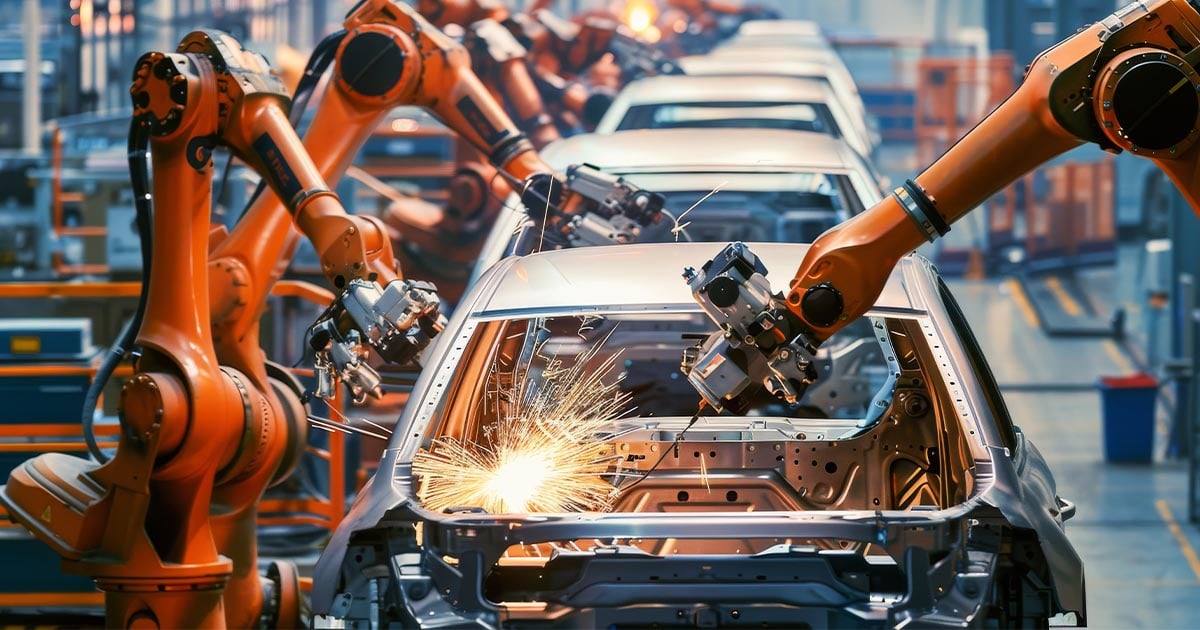

Diversified Industrials Investment Banking

Industrials expertise for middle-market M&A transactions.

Financial Sponsors Group

Dedicated coverage and access to M&A deal-flow for financial sponsors.

Comprehensive Due Diligence Solutions

Our Comprehensive Due Diligence solutions help clients minimize risks and make the most informed business decisions. We support in the areas of tax, compliance and regulatory, operations/strategy, M&A, financial and accounting, investigations, disputes and cyber/IT risk.

2024 Middle-Market Deals of the Year

Kroll's Industrials Investment Banking team wins Mergers & Acquisitions Middle-Market Deals of the Year for their work advising Fleetwood Windows and Doors on its sale to Masonite.

Our Industrials M&A practice has extensive experience advising public corporations, financial sponsors, privately-owned businesses and other middle-market companies on buy-side and sell-side M&A transactions.

Read More