David Althoff

AT A GLANCE

In addition to M&A advisory, David specializes in private placements of debt and equity and financial restructuring advice across multiple industries. He has also given numerous presentations and authored multiple articles pertaining to the mergers and acquisitions market.

Prior to joining Kroll, David served as Vice President at Harris Trust & Savings Bank. David has also held a Representative position at Scotiabank.

David’s experience includes: advising a building products company on its $110 million sale to a European public company; advising a building products company on its $240 million sale to a strategic buyer; advising a manufacturing company on its $190 million sale to a private equity group; advising a manufacturer of food manufacturing equipment on its $85 million sale; advising a distributor of electrical components on its $100 million sale; advising a manufacturer of high-end functional pet food on its sale to a private equity group; and advising a distributor of commercial electrical products on its sale to a publicly-traded private equity fund. David also recently advised on a $150 million capital raise to affect the spin-out of a unit of a publicly traded company.

David received an MBA from Drake University and a BBA from the University of Iowa.

In 2014, David was named one of the Top 50: Americas M&A Investment Bankers by Global M&A Network. He is on the board of trustees for the J.G. Murray Foundation and was honored as the 2015 Morrie Kellman Humanitarian Award Honoree for Little City, a community organization offering a comprehensive scope of services and amenities to individuals with intellectual and developmental disabilities.

Stay Ahead with Kroll

Mergers and Acquisitions (M&A) Advisory

Kroll’s top ranked M&A Advisory practice spans sell-side, buy-side, due diligence, deal strategy and structuring, and capital raising.

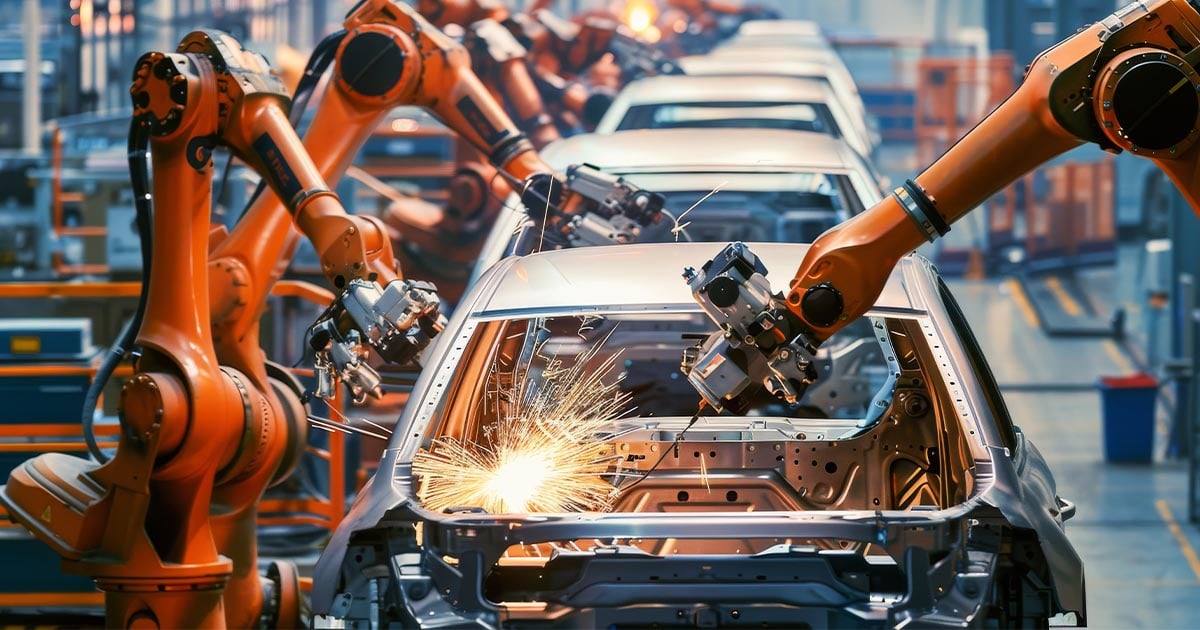

Diversified Industrials Investment Banking

Industrials expertise for middle-market M&A transactions.

2024 Middle-Market Deals of the Year

Kroll's Industrials Investment Banking team wins Mergers & Acquisitions Middle-Market Deals of the Year for their work advising Fleetwood Windows and Doors on its sale to Masonite.

Our Industrials M&A practice has extensive experience advising public corporations, financial sponsors, privately-owned businesses and other middle-market companies on buy-side and sell-side M&A transactions.

Read More