In 2020, upstream deal activity significantly decreased, as both overall deal volume and deal count lacked prior years’ numbers. The spread of COVID-19 heavily affected the entire oil and gas industry as the demand for energy declined temporarily. The volatility of commodity prices observed over the past months has led to many companies suspending projects and deal-making.

The upstream sector consolidation trend we observed before the impact of the COVID-19 pandemic (mainly due to the collapse of crude prices in 2015) was delayed and the majors’ and other large producers’ divestment plans were deferred.

Even though many companies (especially regionally focused and over-levered independents) have entered bankruptcy proceedings and impairments have risen within the sector in 2020, 2021 is turning into a period of recovery as companies are restructuring or discharging their debt.

As a result of the market dislocation encountered in 2020, many exploration and production (E&P) companies are rethinking their exploration strategy for the coming decades and adjusting and refocusing their investment portfolios. Strategic mergers, acquisitions and divestitures should play a key role in building organizational resilience and leveraging core capabilities to increase performance through the commodity price cycle as the energy landscape evolves towards a more emission-conscious business model.

We identify several factors that should boost M&A activity in the oil and gas sector in the foreseeable future:

The Energy Transition of Certain Players to Net-zero Carbon Objectives Will Accelerate Companies’ Transformation

The announcement of low or net-zero carbon objectives from many oil and gas companies will significantly contribute to M&A operations. Majors are spearheading this transformational process and, since the end of 2020, have already put large portfolios of assets up for sale and exited many non-core countries.

The net-zero carbon goals will lead to divestments of underperforming onshore and offshore hydrocarbon assets along with clean technology and new energy acquisitions, such as in the renewable and electrification industries.

Those transactions will likely play a role in how oil and gas companies can build more long-term resilient portfolios and will bring to the market investment opportunities at an attractive price.

The Need to Cut Costs and Achieve Economies of Scale Will Push a Further Consolidation of the Industry

The sector crisis induced by COVID-19 has reinforced the necessity for many players to accelerate their shift from volume to value that dominated the industry before the last cyclical downturn in 2014. Expanding the reserve base and reaching a reserve replacement rate above 100% are no longer amongst key objectives for E&P companies.

Many companies will likely decelerate their efforts to diversify their research and exploration investments in new regions and countries. Many players will rather focus their efforts in certain areas where economies of scale are feasible and where accumulated learning from past experiences will facilitate success.

As oil prices improved since mid-2020, analysts asked oil executives if cash would be directed towards shareholders, the core businesses or the expansion of alternative energy businesses. The balance between investments in core and alternative businesses will determine the level of M&A activity in the upstream sector.

Despite the current price recovery driven by economic recovery, many companies are still overspending, overleveraged and often overextended. Thus, bankruptcies will likely remain elevated as debt becomes due and financing issues remain a challenge for the industry. This situation could open opportunities for countercyclical investments by those with stronger balance sheets.

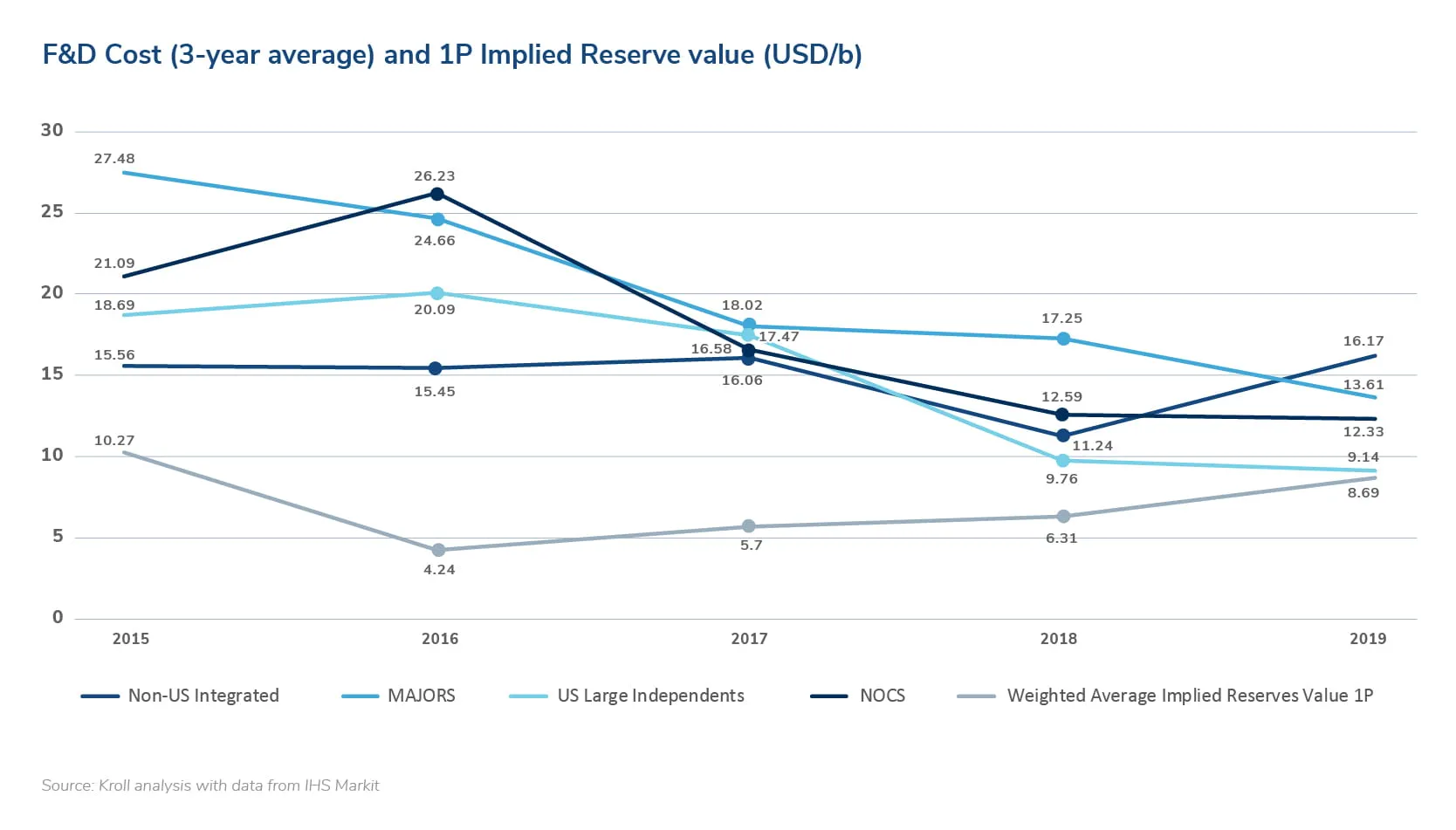

Finding and Development Costs Are Higher Than the Implicit Value of Proven Reserves Acquired Through M&A Operations and the Purchases of Assets or Companies

Historic data shows that the cost of obtaining new reserves via finding and development has been higher than the alternative of acquiring proven reserves in the market, through the acquisition of companies or assets already in production.

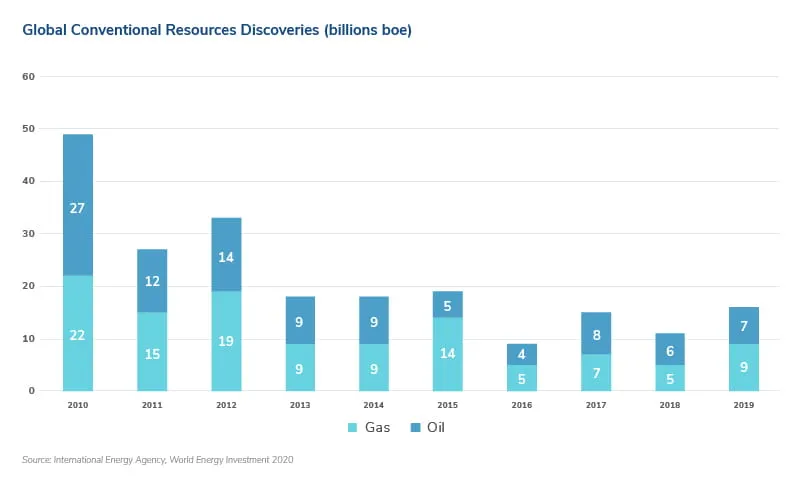

Moreover, the 69th Statistical Review of World Energy, published by British Petroleum (2020), estimates a ratio of proven reserves over production of approximately 50 years, both for crude oil and natural gas. With a long-term declining demand and the necessity of new investments to adapt to climate change policies, many companies have chosen to considerably reduce the budget dedicated to discovering new reserves.

Those companies that want to increase their reserve base will likely prefer to buy proven reserves rather than invest in risky exploration projects.

As a conclusion, the evolution of our overall understanding of the energy landscape and the remaining demand for oil and gas will drive future M&A activity in the upstream sector for the coming periods.

We identify the following key M&A investment criteria for upstream assets:

- Superior risk-adjusted returns based on mitigation of above surface risks through thorough diligence

- Feasibility of economies of scale

- Access to nearby infrastructure

- Low level or mitigation of emissions

- Short investment payback length

How Can Kroll Help

Kroll has a dedicated industry group with more than 100 full-time professionals, combining two essential key success factors in oil and gas transactions: (i) deep operational knowledge and market and legal understanding of the industry and (ii) corporate finance and accounting expertise.

We work with oil and gas organizations to rationalize portfolios, raise private debt and capital, find cost reduction opportunities and successfully navigate regulatory and tax law changes.

The team has advised most major international oil companies on a variety of transactions and strategic issues, ranging from M&A mandates, to full due diligence, valuation advisory, corporate reorganizations and capital raising.

Our team structure provides a flexible approach, and senior management is present throughout every phase of a transaction.

Buy-Side Advisory

From decision support at origination to deal closing and beyond, Kroll supports its clients throughout the deal cycle. Combining market data with fundamental financial competencies, we support critical decision-making with essential advice and information.

We provide our clients with the information they need to make informed business decisions for buy-side transaction projects.

From strategy to execution, Kroll enables oil and gas companies to transact, grow and realize value with greater conviction and speed and the appropriate industry insights,

Sell-Side Advisory

Sellers may face tremendous pressure to drive maximum value by bringing to market assets that are operationally optimized and transaction ready.

Whether the seller is looking to spin-off, carve-out an asset or sell an entire company or business unit, oil and gas companies should focus on selling assets in the same rigorous way they focus on acquisitions.

Kroll’s team can help companies optimize their portfolio and improve divestment strategy and execution through the following vendor assistance actions:

- Assessing the strategy and portfolio management

- Drafting equity story development and delivery

- Executing complete due diligence as a one-stop-shop (financial, commercial, risk and compliance)

- Supporting the negotiation and closing

Private Debt and Capital

Kroll has long-standing relationships with the leading providers of private debt and equity capital and supports our clients in achieving an array of strategic objectives, including:

- Capital structure, capital raising and capital alternatives (recapitalization)

- Financial structuring

- Strategic planning

- Independent view on investment bank and equity research analyst selection, pricing, valuation and equity raising process