By Professor Andrea Boltho, Kroll Real Estate Advisory Group Advisory Board Member, and Emeritus Fellow, Magdalen College, University of Oxford.

First a pandemic, then inflation, now war. The world economy has undergone three adverse shocks in just two years. The last quarterly note stressed widespread uncertainties and a subdued outlook. The present one stresses clear dangers and the possibility of significantly worse prospects. It is true that on the pandemic front the situation in the advanced economies has improved, with the number of new deaths declining for some time now. The developing world, however, remains a weak spot. Vaccination rates are still low in many of the poorer countries, particularly in Africa, and this makes them fertile ground for the birth of new variants. Europe may feel that it has achieved virtual mass immunity and is relaxing many of its restrictions. This may, however, be a premature reaction given the continuing danger of international contagion.

Inflation has risen almost everywhere to rates not seen for many years in both the OECD countries and in most emerging markets. The hope that much of this would be of a transitory nature has now been dealt an almost fatal blow by Russia’s war on Ukraine. Apart from its appalling human cost, the war is having serious negative economic effects. The first and most obvious consequence of both the war and the concomitant sanctions on Russia has been a sharp rise in the cost of energy. Natural gas prices have soared and even the cost of an oil barrel has gone above $100 in March and early April from a 2021 average of $70. Further increases are quite possible should Western Europe significantly reduce its energy imports from Russia (a measure many are calling for) or should Russia itself stop selling gas and oil to Western Europe.

The war is also generating additional inflationary pressures on many other commodities. Food is the most obvious one. Russia and Ukraine together account for some 25-30 per cent of world trade in wheat. There is uncertainty, particularly for Ukraine, on how much of this will be sold given transport difficulties and even on how much will be sown this spring. Grain prices have already risen rapidly. In addition, the production of fertilizers is gas intensive. Rising fertilizer costs are bound to have a negative impact on agricultural production. Russia is also a main producer of many raw materials. Nickel and coal prices have risen sharply and some rare materials (e.g., palladium) could soon be in short supply. Finally, there is also renewed disruption to European supply chains which involve Ukraine and Russia, and also to those reliant on rail transport from China.

The inflationary potential of the war is thus huge. And this is bound to have two unfavourable consequences for activity: central banks may have to raise interest rates by even more than was expected before the war started (though the European Central Bank is, as yet, hesitating at too drastic a reaction), and consumers will find their purchasing power significantly eroded given that wage claims remain subdued, particularly in Europe.

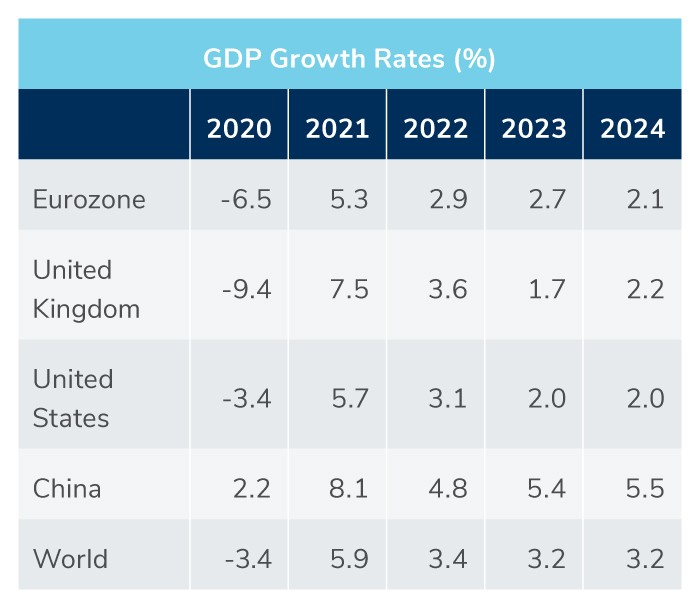

Predicting future trends is clearly much more difficult than usual. Radical uncertainty surrounds the course and duration of the war. And there is uncertainty on whether energy embargoes will be imposed, how food shortages will develop, how severe the next winter will be, whether new COVID-19 variants will emerge, etc. The table below shows tentative forecasts made on the assumption that the war will, in some form or other, end by the autumn of this year. On that basis, the negative effects on the world’s two largest economies, the U.S. and China, will be limited. Output growth may be 0.1 to 0.2 per cent lower than it otherwise would have been in both 2022 and 2023. The slowdowns that are expected in the two countries reflect the rise in interest rates in the U.S. and the COVID-19-linked lockdowns that are being imposed in China. At the opposite end stands Russia’s economy whose GDP by end 2023 could be some 10 to 15 per cent smaller than it was in 2021. Western Europe would, of course, be hurt. Growth in both the Eurozone and in the UK would be up to 1 per cent lower over 2022 and 2023 than had been expected just before the invasion started. Should the war be protracted and continue into next year, the outcomes would, inevitably, be a good deal more unfavourable, with GDP in the Eurozone, for instance, 3 to 4 percentage points below a non-war scenario.

Emerging markets, other than China, are also bound to suffer, particularly in Eastern Europe where mounting uncertainty will depress activity. Elsewhere, inflation is rising at an alarming rate in many economies, pushed higher by energy and food prices. The latter could well generate severe distress in some of the poorest countries. In addition, U.S. interest rates are rising and will continue to do so in the course of this year. Past experience shows that this leads to capital flight from developing countries, generating, in turn, exchange rate depreciation. To counter this, interest rate will almost certainly be increased further thus also dampening activity. Some commodity producers may reap gains from higher raw material prices, but the overall outlook for the emerging world has clearly worsened.

Prospects for the real estate sector will inevitably also suffer. In China, the ongoing downturn looks like continuing. In the advanced economies, the combination of lower growth and greater uncertainty, plus interest rate increases in the U.S. and the UK and, later, also in the Eurozone, are likely to deter both new construction and the acquisition of existing assets. The upward trend in house prices, which last year defied gravity in numerous countries, will almost certainly give way to some declines and the same is likely for commercial properties.

Note: These forecasts are much more uncertain than usual with the balance of risks clearly skewed to the downside.

Source: Oxford Economics

Connect With Us

Stay Ahead with Kroll

Valuation Services

When companies require an objective and independent assessment of value, they look to Kroll.

Real Estate Advisory Group

Leading provider of real estate valuation and consulting for investments and transactions.