Valuation of assets is based on three traditional approaches: market, cost and income. In an appraisal study, all three approaches to value must be considered, as one or more may be appropriate in valuing the subject assets. Value indications that are developed in applying each of the appropriate approaches are reconciled with other facts with regard to the type of asset being appraised and the quantity and quality of the data available in order to form a conclusive estimate of fair value.

What Is Economic Obsolescence?

Economic obsolescence (EO) is the loss in value caused by adverse conditions external to the assets, such as:

- Industry economics

- Regulatory/legislative changes

- Loss or scarcity of resources

- Increased costs of production inputs, or inability to pass on increased costs

- Reduced demand

- Increased competition

- Reduced earnings or profit margins

These factors can result in an economic reduction in value due to added investment requirements or increased operating expenses with no offsetting revenue increases.

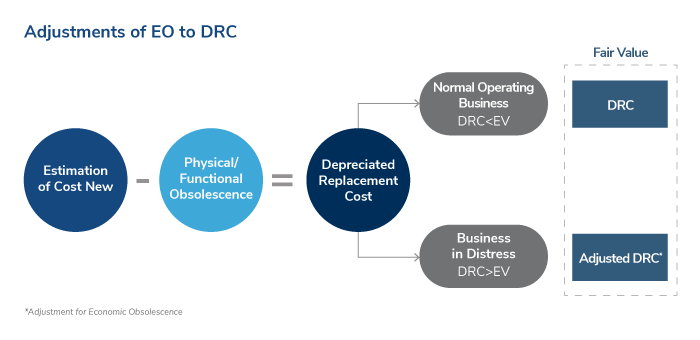

To arrive at an estimate of fair value by cost approach, the cost new should be adjusted for all forms of obsolescence, including EO apart from physical and functional/technological obsolescence. However, EO need not be specifically adjusted while estimating fair value using the market or income approach. Fair value that is determined by using both the market and income approaches captures the loss of value due to EO.

Valuation Perspective

While carrying out valuation of assets of an operating business or property, the following need to be assessed:

- Existence of EO

- Methods to quantify EO

- Application on cost approach

Estimation of Economic Obsolescence

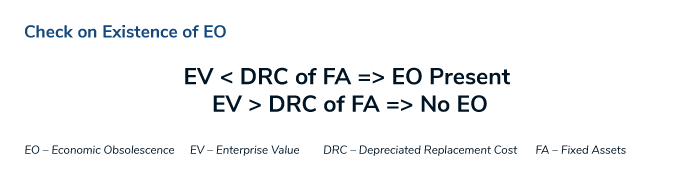

Economic obsolescence is determined by comparing the operating enterprise value of the business derived using the income approach, also known as the discounted cash flow (DCF) method, with the operating tangible assets of the company.

“A situation where operating EV is less than value of operating fixed assets indicates economic obsolescence in assets of that plant. For the plants that are shown to be affected by economic obsolescence, adjustments are made to the Replacement Cost New Less Depreciation and Functional Obsolescence (RCNLDF) to ensure that the fair value of the tangible assets would not fall below its net realizable value.

Enterprise Value As the Comparative Measure to Estimate EO

Economic obsolescence is estimated by comparing the operating enterprise value (EV) of the businesses/plants derived using the income approach/DCF method and/or market approach with the depreciated replacement cost of operating tangible assets of the respective plants/ businesses. A brief description of these approaches is provided below:

Income Approach/Discounted Cash Flow Method

The income method/DCF method uses the future free cash flows of all the stake holders, or free cash flow to firm (FCFF), discounted by the weighted average cost of capital (WACC) to arrive at the enterprise value. In general, the DCF method is considered a strong and widely accepted valuation method, as it concentrates on the future cash generation potential of a business.

Market Approach

The value of the appraised asset is estimated through an analysis of recent sales/transactions of guideline companies/transactions using the following:

- Guideline public company method

- Guideline transactions method

- Price of recent investment

A situation where operating EV is less than value of operating fixed assets indicates economic obsolescence in assets of that plant or business. In the plants or businesses that are affected by economic obsolescence, adjustments are made to depreciated replacement cost, to ensure that the fair value of the tangible assets would not fall below their net realizable value.

Is the Inutility Factor a Replacement of EO?

The Inutility Factor is an adjustment to replacement cost new due to unneeded capacity. When conducting a valuation of tangible property, inutility penalties should always be considered. If the situation warrants a penalty for overcapacity, then an adjustment should be made.

Inutility Analysis

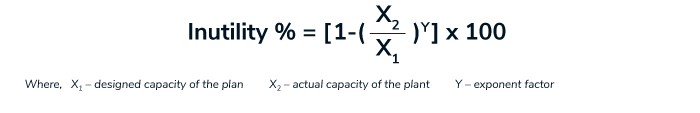

The Inutility Formula can be used to measure a form of EO such as reduced demand for a product due to external factors.

In Inutility analysis, the net capacity is compared with the design capacity. Inutility as a percentage can be depicted as below:

Inutility analysis can be useful to estimate the EO in the absence of an EV estimate. However, this depicts decline in value of the fixed assets due to surplus capacity. It does not address the broader elements of EO that affect the business, such as the economics of the industry.

Following possible situations need to be ascertained before applying inutility penalty:

Scalability of Assets

There can be assets which are not scalable. Some assets need to be built in a certain way to get the desired output. However, despite this, their replacement cost cannot be reduced if their demand is low. It would be unfitting to apply inutility formula in such cases.

Example: A cell tower needs to have certain height and other structural characteristics so that it could be mounted with the required type of network equipment to provide a certain range of network. A smaller tower with lesser cost would not be able to fulfill the network requirement.

Cyclicality of Operations

It is incorrect to apply inutility adjustment on assets with seasonal usage. This might lead to undervaluation of such assets.

Example: A company making winterwear would see an increase in its product demand in winter, while it can have a significant dip in the production in summers. A valuation carried out in summer may observe the assets being underutilized. Applying inutility adjustment can lead to undervaluation of the assets. In this type of business, the “excess capacity” may be needed to meet the higher demands for product during the winter months. A cash flow analysis of the business could certainly indicate that sufficient cash flows were being generated by the assets over the course of the year.

Conditional Use

An asset may be used very intermittently but still be able to generate desired profit. This cannot be considered as low utilization and subjected to inutility adjustment.

Example: A company may own an expensive and a cheaper version of the same asset type wherein the expensive version gives higher quality output while the cheaper version gives comparatively low-quality output. The cheaper version is utilized to serve most their clients while the expensive version is used for customers that require the utmost levels of quality. The expensive version would be used judiciously for limited customers to prevent its output quality from deteriorating due to overuse. If a valuation focuses on the fact that higher quality assets are used 50% to 60% of the time, it will result in a significant reduction in value if the inutility adjustment is used. When the company purchased the more expensive equipment, it did take into consideration the cash flows that would be generated by the equipment by only using it sparingly for certain customers demanding the highest quality product and determined there was economic support for this purchase.

Full Asset Utilization ≠ No EO

Contradictory to the above scenarios, there can be a scenario where the plant is running at full capacity and still have EO as it is not able to produce adequate earnings to support the value of the assets, thereby leading to impairment. In this case, inutility adjustment would again be an incorrect approach.

The above scenarios suggest that the application of the Inutility Factor should be done very judiciously.

Application of EO

Once EO existence had been checked, analyzed and quantified, the final task is to apply the EO conclusions in the cost approach. This requires cautious thinking and questions to be asked such as:

- Should the same or different percentage of EO be applied to all the assets?

- Should EO be applied only to a certain group of assets?

Stay Ahead with Kroll

Valuation Services

When companies require an objective and independent assessment of value, they look to Kroll.

Real Estate Advisory Group

Leading provider of real estate valuation and consulting for investments and transactions.

Alternative Asset Advisory

Heightened regulatory concerns and vigilance, together with increased investor scrutiny, have led to increased demand for independent expert advice.