We are pleased to present the 2021 U.S. Goodwill Impairment Study (the “2021 Study”), now in its 13th year of publication. The 2021 Study examines general and industry goodwill impairment (GWI) trends through December 2020 of over 8,900 publicly traded companies incorporated in the U.S.

Our inaugural study was launched in 2009 and focused on capturing GWIs recorded by U.S.-- based companies and industries at the onset of the global financial crisis of 2008-2009. We find ourselves again in a period of significant upheaval, with companies forced to navigate the global economic crisis created by the COVID-19 outbreak.

Download the Report

This year’s edition also takes a closer look at the largest 30 impairments recorded during 2020. As an additional feature this year, we provide information on the segment and reporting unit structure of these 30 companies, to the extent that such information was disclosed in financial statements. Finally, this study also aggregates the GWI taken by U.S.-based companies up to the time of writing for calendar year 2021, which demonstrates the extraordinary pace at which many companies and industries recovered from the COVID-19 recession.

Highlights of the Study

- Total GWI recorded by U.S. public companies more than doubled in 2020, from $71.0 billion (bn) in 2019 to $142.5 bn in 2020, but still fell short of the level observed in 2008 ($188.4 bn), at the onset of the global financial crisis of 2008--2009.* The COVID-19 outbreak led to the worst global economic recession since World War II. Most major economies saw sizable contractions in 2020, with real GDP declining by 3.4% in the U.S., far exceeding the drop observed in 2009.

- The number of GWI events increased by 45%, from 318 in 2019 to 462 in 2020, but again below the number recorded in 2008 (502). The size of impairments became larger, with the average GW I per event rising by 38% in 2020 to $308 million (mn), the second highest level since the record in 2008 of $375 mn.

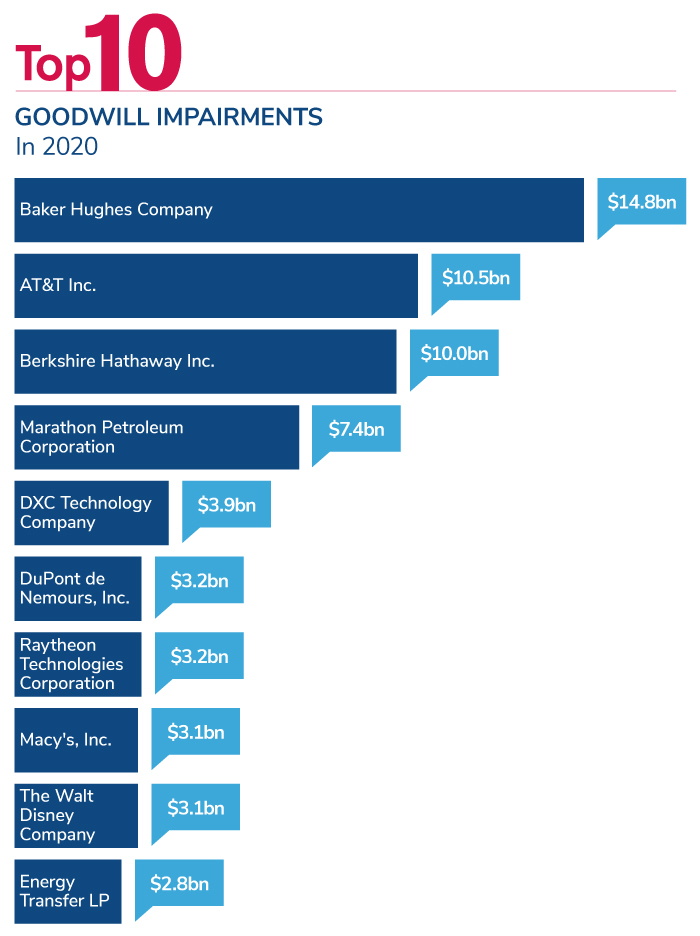

- In 2020, the top five impairments totaled $46.5 bn, while the top 10 impairments reached $61.9 bn, accounting for nearly 33% and 43% of the aggregate GWI of $142.5 bn, respectively.

Goodwill Impairments by Industry

From an industry standpoint, GWI increased or remained at similar levels in eight out of the ten industries analyzed, with Consumer Staples and Healthcare being notable exceptions. These two industries were also the least impacted by the pandemic, with the former benefitting from stay-at-home lockdown policies and the latter (which includes pharma and biotech companies) facing increased demand created by the health crisis.

Conversely, Energy was especially hard hit in 2020, reaching the top of the GWI table, pushing Communication Services down to the second spot. Notably, Communication Services continued to see a significant rise in impairment activity for a second consecutive year, registering a record number of impairments in 2020 and an aggregate GWI of $27.5 bn, the highest level since 2007.

The industries with the largest increase in GWI in 2020 relative to 2019, are as follows in order of magnitude ($ in billions):

- Energy ($8.7 to $41.7)

- Financials & Real Estate ($0.4 to $19.1)

- Industrials ($4.5 to $13.2)

The graphic below highlights trends in the aggregate GWI amount for each of the 10 industries analyzed over the period 2016-2020.

Goodwill Impairments by Industry ($ in Billions)

The economic and business outlook improved markedly in 2021, as the approval of new COVID-19 vaccines and the increased rate of vaccination allowed for the reopening of the U.S. economy.

At the time of writing, the disclosed top 10 GWI events for 2021 reached a combined $5 bn, which pales in comparison to the top 10 in 2020 of $61.9 bn. Although full 2021 calendar year-end results for U.S. public companies will not be known for some time, early reporting points to overall GWI merely reaching $7 bn in 2021. Even if GWI increases slightly from this level, an amount this low has not been observed since 2006.**

Download the Report

Notes

* The 2021 Study only captures companies that are incorporated in the U.S. Therefore, certain companies that are incorporated outside of the U.S. are excluded from our analyses, even if they are viewed as U.S. companies by financial markets. If such companies were included, total GWI would, at a minimum, increase by Schlumberger’s $8.8 bn impairment in 2019 and $3.1 bn in 2020, leading respectively to an aggregate $79.9 bn and $145.6 bn in each year.

** Data for calendar year 2021 was compiled on February 28, 2022. The identity of the top 10 largest impairment events in 2021 may change once all companies report full-year 2021 results.

Stay Ahead with Kroll

Valuation Services

When companies require an objective and independent assessment of value, they look to Kroll.

Goodwill and Intangible Asset Impairment

Kroll is a leading provider of goodwill, intangible and long-lived asset impairment testing.