HMRC has published additional guidance on how to opt into the VAT deferral scheme in respect of VAT payments deferred from the period 20 March 2020 to 30 June 2020.

In order to ensure that penalties and interest charges are avoided HMRC has advised that a business should either pay the deferred VAT in full by 31 March 2021, or agree extra help to pay with HMRC by 30 June 2021 or opt into the new scheme by 21 June 2021 which can be conducted via your client's HMRC VAT portal.

The date of registration will determine the maximum number of payments which is as follows:

- 10 for those who register before 21 April

- 9 for those who register before 19 May

- 8 for those who register before 21 June

It is understandable that many SMEs will be concerned about arrears that they have accumulated with HMRC across all tax classes during the pandemic. Whilst there has been much welcomed support and forbearance shown by HMRC in the last 12 months, it is clear that as restrictions ease in accordance with the government’s roadmap out of lockdown, HMRC will seek proposals from companies for the repayment of arrears of tax.

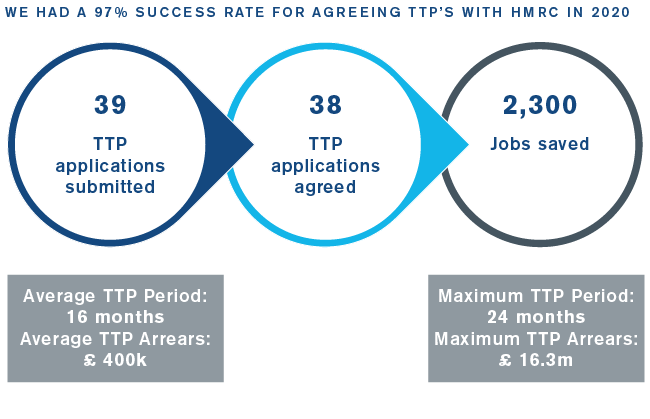

Kroll is here to help you help you/your clients. Working alongside you, we can assist you/your clients in securing the optimal Time to Pay (TTP) arrangements available, ensuring repayments are affordable and in line with expected future trading performance. We ensure that forecasts are prepared prudently and also include reasonable headroom for underperformance, especially in light of the ongoing uncertainty facing many UK businesses. The annual statistics summarized below, combined with our success rate of 97%, are a strong reflection of the positive working relationship we have built with all debt management departments within HMRC over the last 15 years.

Our team works tirelessly to achieve the best possible outcome for you/your clients, whilst also preserving businesses in difficulty and safeguarding jobs. Our experts are here to help you/your clients navigate the processes of agreeing standstill agreements, formal repayment arrangements of existing arrears and even to agree forbearance with respect to future liabilities. We fully understand HMRC’s processes and expectations and can deliver solutions to a range of challenges, including large debts, requests for security and threats of enforcement action. Kroll can also provide additional services needed to underpin a robust TTP proposal, including financial forecasting, debt advisory services and profit improvement and operational turnaround advice. HMRC non-compliance can sometimes trigger covenant breaches of existing funding arrangements and Kroll can assist with negotiations and reporting to banks, asset-based lenders and other key stakeholders.

Stay Ahead with Kroll

Restructuring

Financial and operational restructuring and enforcement of security, including investigation, preservation and realization of assets for investors, lenders and companies.