The world’s economic outlook is hardly improving. The last quarterly note stressed the danger of a significant worsening in prospects, and unfortunately, this danger is materializing. Output growth is decelerating almost everywhere, inflation is accelerating almost everywhere, the growth of world trade is slowing down and Russia’s war on Ukraine shows no signs of abating. Fears of stagflation, or indeed, recession are now spreading across much of the world. The only mildly good news is that the pandemic is in retreat. This success remains fragile given that new variants may still emerge, but for the time being COVID is no longer having significant negative effects on economic activity (with the partial exception of China - see below).

The headlines are dominated by inflation. This is now approaching double digits in the U.S. and Western Europe and is often above such rates in many countries in Eastern Europe, the Middle East, Africa and Latin America (the only major exception remains Japan). Most forecasts, however, expect inflation to return to much lower rates already next year. What justifies such optimism? One reason is that some of the recent upsurge in prices reflects transitory increases that followed the deflation of 2020-21. More importantly, there is yet little evidence of a wage-price spiral which would be needed for inflation to become entrenched. Wage settlements have so far remained relatively modest in many of the richer countries. This, in turn, will also contribute indirectly to the weakening of inflation. Since real wages are often declining, so does purchasing power, and this weakens demand pressures. And a similar dampening of demand pressures comes from the sharp rises in interest rates that have already occurred and will be further pursued, particularly by the Federal Reserve System, by the Bank of England and soon also by the European Central Bank (ECB).

While some cautious optimism may, therefore, be warranted as far as inflation goes (but see below), the same cannot be said for output growth. Falling purchasing power and rising interest rates are depressing both industrial and consumer confidence. The U.S. seems so far to be more affected than Western Europe given the speed of its monetary tightening. The Eurozone, however, could suffer as well should it impose a full oil embargo on Russia or should Russia strengthen its recently introduced policy of withholding gas supplies. Energy shortages would further add to inflation and the possible introduction of schemes to ration gas this winter to industrial users (openly discussed now in Germany and other countries) would, inevitably, affect output. Indeed, a full gas embargo by Russia would almost certainly trigger a recession in Europe. Even without it, the combination of earlier supply shocks, very high debt levels and synchronized monetary policy tightening bodes ill for the future.

Within the Eurozone, Southern Europe is expected to perform relatively well this year thanks to a strong revival in tourism. However, a potential problem for the Eurozone is to be found in the reopening of interest rate spreads between Germany and some of the Southern countries. As the ECB raises interest rates, it will be unable to continue its policy of bulk buying government debt. Italy is particularly at risk. The country’s potential growth rate is low, public- sector deficits are large, and the public debt/GDP ratio is high. In addition, Italy is now facing a rise in debt servicing costs and could, next year, have a government run by right-wing populist parties skeptical about the euro and even the EU. Market pressures could easily escalate and force Italy into unwanted austerity. The ECB has promised to help avoid what it calls “fragmentation” (i.e., differences in monetary conditions across the euro area), but its intervention, if it occurs, is likely to be subject to conditions that Italy may find difficult to meet. Tensions, in other words, are resurfacing and they could have negative effects on growth, not just in the Southern Eurozone.

In the emerging world, China’s economic situation remains quite robust. Inflation is relatively low, and Russia’s war on Ukraine is having only a very marginal impact. But the so-called “zero-COVID-19” policy imposed by the authorities is interfering with economic activity. The appearance of infections, even if in very small numbers, has led to draconian lockdowns of entire cities (Shanghai, for instance, was almost completely shut for over one month). Given the easy transmissibility of the Omicron variant, there is a danger that new or renewed city-wide lockdowns could be imposed across the country. Tentative estimates suggest that such policies could reduce growth this year by 1 percentage point of GDP, if not more. Elsewhere in the emerging world, the difficulties are much greater. As in the developed world, inflation is rampant because of soaring food and energy prices, only more so. In addition, rising U.S. interest rates are weakening many currencies, adding to inflationary pressures and forcing countries to raise their own interest rates. Growth prospects have been sharply reduced. Among the major economies at risk are Argentina, Colombia, Egypt, Pakistan, South Africa, Turkey, etc. And a further fear is that 2023 could see some countries actually suffering from famines if the continuation of the war in the Ukraine prevents the harvesting and the export of wheat from that country and, possibly, also from Russia. That, in turn, could lead to riots and political turmoil.

Turning to the real estate sector, low interest rates and savings accumulated during the pandemic fueled rapid increases in residential real estate prices over the last two years in many of the advanced countries. Sharply rising interest rates and the expected growth slowdown (or recession) are bound to have the opposite effect in coming months. By next year, house price declines could be widespread though the impending crisis will probably not be as severe as the one that followed the Great Financial Recession of 2008-2009. This would partly reflect the spread of fixed rate mortgages, partly healthier household balance sheets and partly also a relative scarcity of accommodation following the shift in many countries to remote working. The same, however, is unlikely to be the case for office buildings.

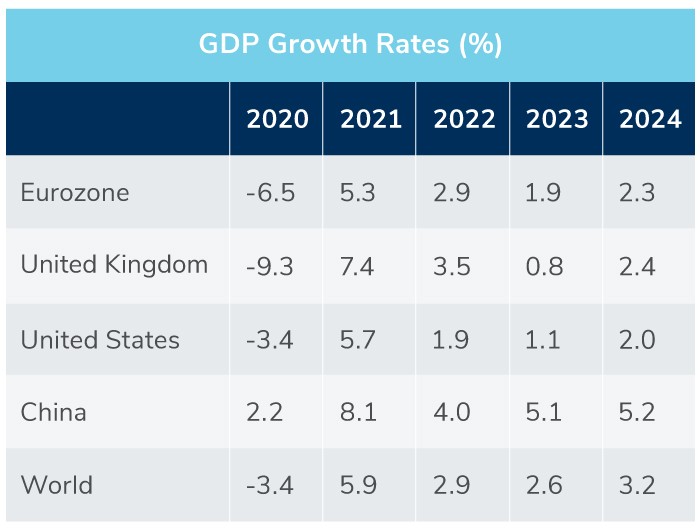

As was stressed in the last quarterly note, forecasts are at present surrounded by even greater margins of uncertainty than usual. The table below shows projections which assume that the war’s effects will last into mid-2023 but also that inflation will gradually slow down in both the U.S. and Europe. None of these outcomes are at all certain. A prolonged war, for instance, would lead to negative growth rates in Europe and zero growth in the U.S. in 2023.

Connect with Us

Stay Ahead with Kroll

Real Estate Advisory Group

Leading provider of real estate valuation and consulting for investments and transactions.

Valuation Services

When companies require an objective and independent assessment of value, they look to Kroll.