Millennials Prefer Owning/Leasing a Car Over Ride-Hailing Services

Globally, 75% of millennials chose owning/leasing a car over using ride-hailing services, if they would cost the same.

We also asked millennials about the fairly recent phenomenon of ride-hailing services (e.g., Uber, Lyft, Didi). Questions included whether these services were available in their neighborhood, whether they would cost the same as owning/leasing a car with insurance, and whether they would prefer owning/leasing a car or using a ride-hailing service. Overwhelmingly, 75% of millennials chose owning/leasing a car to ride-hailing. The results varied slightly by region, with Latin America at the low end with 66% and the U.S./Canada at the high end at 86%.

Preference in Car Ownership/Lease Vs. Ride-Hailing Services, If the Cost was Equal

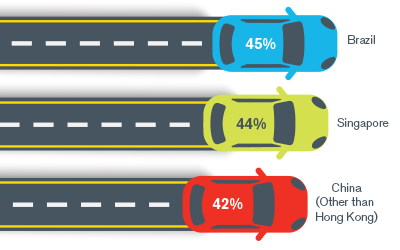

By country, outliers include Brazil at 55% choosing car ownership/leasing, China (other than Hong Kong) at 58%, Italy at 62% and Singapore at 56%. These results, taken together, indicate that when cost is not a factor, millennials prefer to have their own car over using a ride-hailing service.

Brazil, Singapore and China Show the Most Interest in Ride-Hailing Vs. Owning/Leasing a Car Over Other Countries

This preference might have something to do with the high costs of reliance on ride-hailing24 compared to car ownership. Given this significant difference in cost and millennials’ preference of car ownership when cost is not a factor, it does not appear that ride-hailing will likely be a significant threat to car ownership/leasing for the millennial generation.

Source

24 Stefan Knupfer, Vadim Pokotilo, and Jonathan Woetzel, “Elements of success: Urban transportation systems of 24 global cities,” McKinsey & Company, accessed September 25, 2019, https://www.mckinsey.com/business-functions/sustainability/our-insights/elements-of-success-urban-transportation-systems-of-24-global-cities.

Relevant Articles

Connect With Us

Stay Ahead with Kroll

Mergers and Acquisitions (M&A) Advisory

Kroll’s top ranked M&A Advisory practice spans sell-side, buy-side, due diligence, deal strategy and structuring, and capital raising.

Transaction Advisory Services

Kroll’s Transaction Advisory Services platform offers corporate and financial investors with deep accounting and technical expertise, commercial knowledge, industry insight and seamless analytical services throughout the deal continuum.

Financial Sponsors Group

Dedicated coverage and access to M&A deal-flow for financial sponsors.

Debt Advisory

Kroll has extensive experience raising capital for middle-market companies to support a wide range of transactions.

Transaction Opinions

Our Transaction Opinions solutions span fairness opinions, solvency opinions, ESOP/ERISA advisory, board and special committee advisory, and complex valuations.

Diversified Industrials Investment Banking

Industrials expertise for middle-market M&A transactions.

Valuation Services

When companies require an objective and independent assessment of value, they look to Kroll.