Merger & Acquisition (M&A) deal activity in the U.S. and Canadian food and beverage industry slowed down slightly in 2019, with 276 deals closing over the year.

The market witnessed several major transactions through Q3 and Q4 2019, including the divestiture of a portfolio of wine and spirit brands by Constellation Brands to E. & J. Gallo Winery for $1.1 billion, which was re-announced on December 12, 2019, after being amended due to concerns brought forward by the Federal Trade Commission, and the acquisition of Arnott’s Biscuits Holdings and related business of Campbell Soup Company by KKR & Co. Inc., which closed on December 23, 2019, with a transaction value of $2.2 billion.

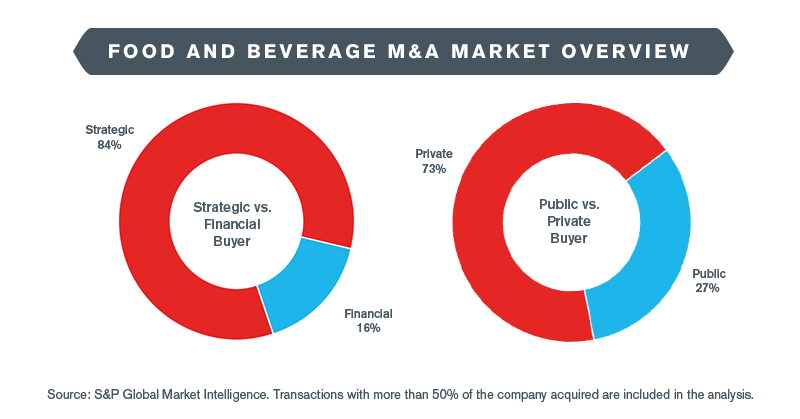

M&A activity in the food and beverage sector is still predominately driven by strategic buyers (including companies primarily owned by private equity investors), with strategic transactions representing 84% of total deal value over 2019. Of the 276 deals closed over 2019, 202 (73%) were completed by privately owned buyers.

Overall deal volume in 2019 decreased 1.5% relative to the 303 deals closed over 2018 and remains flat relative to the 276 deals closed in 2017.

Robust deal flow continues to be seen in the healthy snacking category, with large strategic acquirors and financial sponsors both showing strong interest in brands perceived by consumers to be both convenient and nutritious. Recent transactions such as The Hershey Company’s acquisition of ONE Brands LLC and Mondelez International Inc.’s acquisition of Perfect Bar LLC show that the large incumbents of the traditional confectionary and snack food sector are still eager to acquire healthy brands in order to stay relevant with today’s consumers.

Source: Capital IQ as of December 31, 2019.

Note: M&A deal count is defined by a list of subsectors viewed as the best representation of the industry.

Stay Ahead with Kroll

Mergers and Acquisitions (M&A) Advisory

Kroll’s top ranked M&A Advisory practice spans sell-side, buy-side, due diligence, deal strategy and structuring, and capital raising.

Consumer, Food, Restaurant and Retail Investment Banking

Consumer, Food, Restaurant and Retail expertise for middle-market M&A transactions.

Transaction Advisory Services

Kroll provides comprehensive due diligence, operational insights, and tax structuring support, assisting private equity firms and corporate clients throughout the deal lifecycle.

Transaction Opinions

Our Transaction Opinions solutions span fairness opinions, solvency opinions, ESOP/ERISA advisory, board and special committee advisory, and complex valuations.

Financial Sponsors Group

Dedicated coverage and access to M&A deal-flow for financial sponsors.

Distressed M&A and Special Situations

Kroll professionals have advised hundreds of companies, investors and other stakeholders at all stages of distressed transactions and special situations.

Debt Advisory

Kroll has extensive experience raising capital for middle-market companies to support a wide range of transactions.