Following the lifting of domestic COVID-19 restrictions and boosted by a recovery in retail consumption, China's economic growth rebounded to 4.5% for the first quarter of 2023, an uptick from the 2.9% GDP growth registered in the fourth quarter of 2022.

Following the lifting of domestic COVID-19 restrictions and boosted by a recovery in retail consumption, China’s economic growth rebounded to 4.5% for the first quarter of 2023, an uptick from the 2.9% GDP growth registered in the fourth quarter of 2022. The economy also recorded increases in fixed asset investment (4.0%), value-added industrial output (3.6%) and foreign trade (4.7%) for the first five months of 2023.1

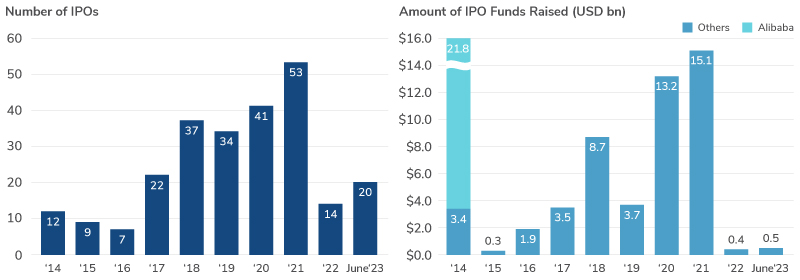

The first half of 2023 saw a modest recovery in the pace of U.S. IPO activity for Chinese companies after the significant drop-off in listings in 2022.2 However, activity remains well below the levels seen in 2020 and 2021, as market conditions and continued regulatory concerns have created a challenging environment for offshore listings of Chinese companies in the U.S.

Going-private transaction activity for U.S.-listed companies based in China slowed in 2023, with only one privatization completed during the year through June and two potential transactions announced that have yet to close. U.S.-listed Chinese companies with pending going-private proposals represented about USD 4.5 billion in total market capitalization as of June 30, 2023

Connect with Us

China Transactions Insights Valuation Data

The first half of 2023 saw a modest recovery in the pace of U.S. IPO activity for Chinese companies after the significant drop-off in listings in 2022. However, activity remains well below the levels seen in 2020 and 2021. Download our China Transactions Market and Transaction Data for more insights across IPO’s, Going Private Transactions and more.

Stay Ahead with Kroll

Mergers and Acquisitions (M&A) Advisory

Kroll’s top ranked M&A Advisory practice spans sell-side, buy-side, due diligence, deal strategy and structuring, and capital raising.

Transaction Advisory Services

Kroll provides comprehensive due diligence, operational insights, and tax structuring support, assisting private equity firms and corporate clients throughout the deal lifecycle.

Transaction Opinions

Our Transaction Opinions solutions span fairness opinions, solvency opinions, ESOP/ERISA advisory, board and special committee advisory, and complex valuations.