Despite the adverse effects of the COVID-19 pandemic (with an expected GDP contraction of 4.5% in 2020) and a certain level of uncertainty in the political arena, the Brazilian economy is showing signs of a strong recovery in Q3 2020, driven by internal demand and fast-maturing capital markets.

The federal government remains committed to a series of important structural reforms, including the simplification of the over-complex domestic tax environment and the administrative reform, aimed to reduce public spending. The privatization program remains one of the main priorities in the government’s agenda for the coming months, pointing to relevant opportunities for long-term investments in infrastructure and the foundation of the country sustained growth.

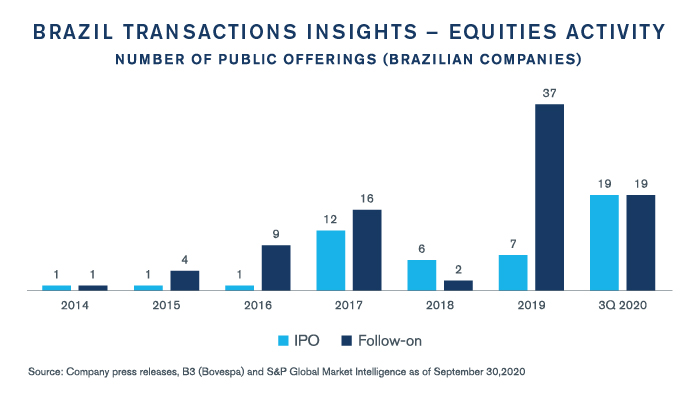

With domestic interest rates at an all-time low of 2% p.a., there is an ongoing, positive revolution underway in the Brazilian capital markets, driven by a strong shift in traditionally low-risk investments to the real economy. IPO volume in 2020 at record levels and the massive increase in individual investors in the local stock exchange are signs of this new scenario.

As in the rest of the world, Brazil’s challenging time with the economic downturn reflected in M&A activities during the H1 2020. The country is seeing a V-shape recovery in M&A activity and record number of operations is expected in 2020.

Connect With Us

Stay Ahead with Kroll

Mergers and Acquisitions (M&A) Advisory

Kroll’s top ranked M&A Advisory practice spans sell-side, buy-side, due diligence, deal strategy and structuring, and capital raising.

Transaction Advisory Services

Kroll’s Transaction Advisory Services platform offers corporate and financial investors with deep accounting and technical expertise, commercial knowledge, industry insight and seamless analytical services throughout the deal continuum.

Transaction Opinions

Our Transaction Opinions solutions span fairness opinions, solvency opinions, ESOP/ERISA advisory, board and special committee advisory, and complex valuations.

Financial Sponsors Group

Dedicated coverage and access to M&A deal-flow for financial sponsors.

Distressed M&A and Special Situations

Kroll professionals have advised hundreds of companies, investors and other stakeholders at all stages of distressed transactions and special situations.

Debt Advisory

Kroll has extensive experience raising capital for middle-market companies to support a wide range of transactions.