As in the Middle East, the risk profile of organizations in sub-Saharan Africa is dominated by bribery and corruption, reported by 33 percent of the region’s respondents (vs. 23 percent globally), and fraud, with 44 percent reporting fraud by internal parties (vs. 27 percent globally). Not surprisingly, employees are more likely than average to be the source of incidents (29 percent vs. 24 percent globally). The region also reports a greater percentage of incidents (10 percent vs. 6 percent globally) caused by politically motivated actors, a group that includes government officials.

To meet these challenges, organizations in the area will have to realign their risk priorities. The 67 percent that prioritize combating fraud by internal parties is not materially higher than the global average (66 percent); fighting bribery and corruption is at the bottom of the mitigation list, with 56 percent making it a priority (vs. 62 percent globally). Further, organizations in sub-Saharan Africa place their greatest priority on mitigating disruption due to sanctions, tariffs, and changes in trade agreements, despite their lower overall likelihood of being affected by geopolitical risks.

Many organizations in the region have recently placed a greater emphasis on establishing a culture of transparency and accountability as part of their ongoing integration into global trade and investment. These developments are reflected in organizations’ level of confidence in key cultural practices. For example, 87 percent of respondents in sub-Saharan Africa agree that there is a clear message from the top of their organizations that integrity, compliance and accountability are important (vs. 78 percent globally). These findings, together with those revealing high levels of bribery and corruption and of fraud by internal parties, suggest that the region is in a period of transition regarding these risks and that further progress is warranted.

Organizations in sub-Saharan Africa report practicing reputational due diligence with an above-average frequency for many categories of third parties, including investors: 93 percent conduct due diligence on this group (vs. 84 percent globally). However, the region lags in performing reputational due diligence on customers (75 percent vs. 88 percent globally).

A regional economy that is focused on natural resources and still in the process of developing infrastructure makes sub-Saharan Africa particularly vulnerable to risk from climate change; respondents there are more likely than those anywhere else to report concern over the future impact of this threat (67 percent vs. 54 percent globally). And while parts of sub-Saharan Africa have become more politically stable of late, the risk of unrest still looms large: Three-quarters of respondents in the region named that as a concern, a higher percentage than nearly anywhere else (vs. 63 percent globally).

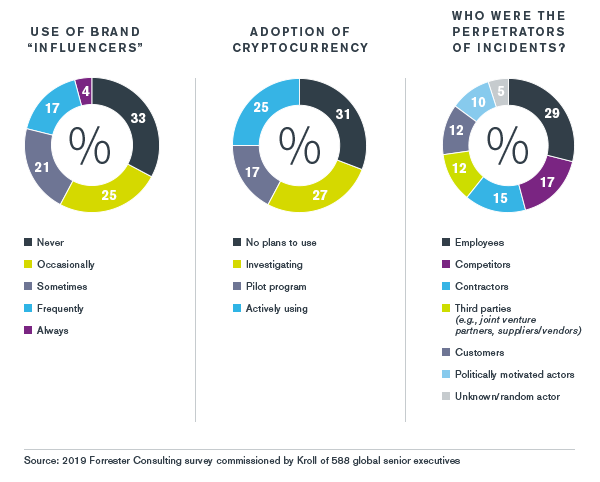

The high percentage of Africans without access to financial institutions suggests that the region could be receptive to cryptocurrency. So far, however, regulators’ concern about fraud and other risks has slowed the platform’s adoption, with nearly one-third of respondents in the region (31 percent) reporting that their organizations have no plans to adopt cryptocurrency (vs. 19 percent globally).