In many areas, Japan’s survey results depart significantly from global averages. This reflects the extent to which respondents’ organizations are grappling with shortcomings in internal controls and in keeping pace with the effects of geopolitical forces on the risk landscape.

As elsewhere, respondents in Japan name leaks of internal information, reputational damage due to third-party relationships and data theft as the most common significant incidents in the last 12 months. Other threats, however, occur notably less often in Japan. Bribery and corruption are reported by only 13 percent of respondents in Japan (vs. 23 percent globally), as the large-scale reform that took place in the 1990s continues to bear fruit. Money laundering is reported by a scant 2 percent of respondents in Japan (vs. 16 percent globally); the extent to which this reflects systemic improvements in Japan’s anti–money laundering regulations and controls will be seen after the review this year by the Financial Action Task Force.

Geopolitical issues do not receive the focus in Japan that they do elsewhere. Organizations in Japan are less likely than those in any other country to name disruptions due to sanctions and tariffs as a risk priority (38 percent vs. 62 percent globally) and report being less affected by geopolitical risks in general. Respondents in Japan are among the least likely to be concerned about the future possibility of a breakdown of intergovernmental mechanisms for dispute resolution, free trade and combating corruption (44 percent vs. 61 percent globally).

A series of high-profile scandals involving falsified inspections has led to national introspection regarding business culture, performance pressure and economic turbulence. The effect of these events can be seen at a number of points in the survey data. A notably lower percentage of incidents in Japan were discovered through internal audit than elsewhere (20 percent vs. 28 percent globally), with a greater reliance on regulators (20 percent vs. 13 percent globally) and whistleblowers (17 percent vs. 13 percent globally). In the same vein, respondents in Japan are much less likely to rate their internal detection capabilities, such as cybersecurity (56 percent vs. 81 percent globally), reputational due diligence (50 percent vs. 73 percent globally) and data analytics (50 percent vs. 77 percent globally), as effective or highly effective. Similarly, respondents in Japan are much less likely to agree that their organizations follow many of the practices that promote transparency and accountability.

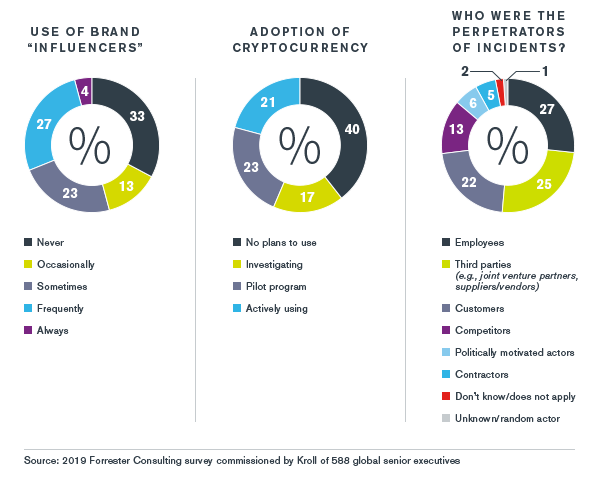

A year ago, Japan stood out in the global arena for its welcoming attitude toward cryptocurrency. Multiple thefts at cryptocurrency exchanges, however, have resulted in greater skepticism toward digital financial platforms: The percentage of Japanese organizations reporting that they do not plan to use cryptocurrency is more than double the global average (40 percent vs. 19 percent overall).

Respondents in Japan are notably less likely than those in other countries to be concerned about the array of future risks presented in the survey. Interestingly, Japanese respondents are furthest from the global average when considering risks that can be addressed through government intervention, such as destabilization of fiat currency due to cryptocurrency (35 percent vs. 53 percent globally) and a breakdown of intergovernmental dispute resolution (44 percent vs. 61 percent globally).