Global Fraud and Risk Report 2019/20 – Transportation, Leisure and Tourism Overview

Our survey suggests that the transportation industry has a heightened susceptibility to bribery and corruption. Within this industry (which in our survey also includes leisure and tourism), 36 percent of respondents report that their organizations have experienced significant incidents of bribery and corruption in the past year—a far higher percentage than in any other industry and one that substantially exceeds the 23 percent average across all industries. However, only 64 percent of industry respondents say they have prioritized combating it (vs. 62 percent for all industries). Perhaps this is because transportation industry respondents are currently more likely than average to view their anti-bribery and anti-corruption controls as effective (74 percent vs. 69 percent for all industries).

One way in which the industry can attempt to mitigate bribery and corruption is through its corporate culture. Transportation is on par with other industries in agreeing that there is a clear message from the top of their organizations that integrity, compliance and accountability are important (79 percent vs. 78 percent for all industries). However, transportation respondents are far less likely than those from any other industry to assert that, in their organizations, performance goals and incentives do not conflict with risk management practices (58 percent vs. 71 percent for all industries). Respondents from this industry are also the least likely to concur that new business initiatives are regularly examined for appropriate risk implications (62 percent vs. 74 percent for all industries). The combination of these two findings—personal performance pressure that can supersede internal controls combined with insufficient attention to risk at the strategic level—can easily create an environment hospitable to bribery and corruption. This situation can be expected to be even worse in regions that have a high baseline level of corrupt behavior along with insufficient regulation and enforcement.

The industry’s need for more robust internal controls can also be seen in how its incidents are detected. In no other industry are risk incidents more likely to be revealed by external audit (22 percent, matching the financial services industry, vs. 17 percent for all industries) or by whistleblowers (16 percent vs. 13 percent overall). Having a strong framework to encourage and protect whistleblowers is important, but it is also crucial to note that employees usually resort to whistleblowing when they have little confidence that they will get results through less disruptive channels.

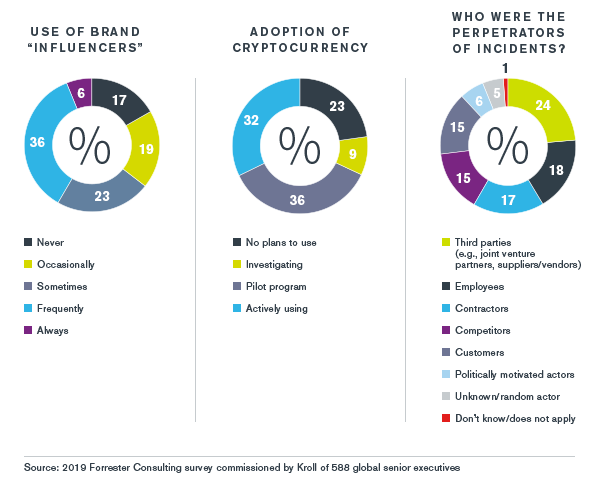

The transportation industry—presumably led in this case by its leisure and tourism components—has actively embraced the use of brand ambassadors and social media influencers. Transportation respondents are more likely than people in any other industry to say their organizations frequently follow this communications strategy (36 percent vs. 23 percent for all industries). But the double-edged nature of social media is also evident: 34 percent of transportation respondents report having faced adversarial social media activity within the past year (vs. 27 percent for all industries).