Respondents in the consumer goods industry experience problems predominantly in two key areas of the value chain. The first is reputational damage caused by third-party relationships (34 percent vs. 29 percent for all industries). The second is counterfeiting and gray market activity (26 percent vs. 17 percent for all industries).

Adverse incidents caused by third-party relationships are most often due to issues in the supply chain. Consumers now place a much greater emphasis on the integrity of the supply chain and the ethical standards of the brands whose products they buy. So it is that consumer goods organizations are more likely than those in any other industry to prioritize mitigating against reputational damage caused by third parties (84 percent vs. 73 percent for all industries). However, this concern is not always manifest in practice. While consumer goods companies are more likely than the average of all industries to conduct reputational due diligence on some stakeholders, they are slightly less likely to do so on business partners and suppliers. Given the industry’s branding concerns, reputational due diligence on these two groups should be standard practice.

Counterfeiting and gray market activity remain persistent problems. In our survey, 26 percent of consumer goods companies report experiencing significant counterfeiting incidents within the last 12 months (vs. 17 percent for all industries). Counterfeiting infringements are so frequent that many businesses find they have to be selective in the cases they choose to pursue.

Respondents in the consumer goods industry acknowledge that their companies instill a strong culture of transparency and accountability. A significant majority of respondents say they get a clear message from the top of their organizations that a culture of integrity is important (88 percent vs. 78 percent for all industries), and the proportion who agree that their companies respond to risk management incidents in consistent ways is higher than in any industry besides life sciences (84 percent vs. 75 percent for all industries).

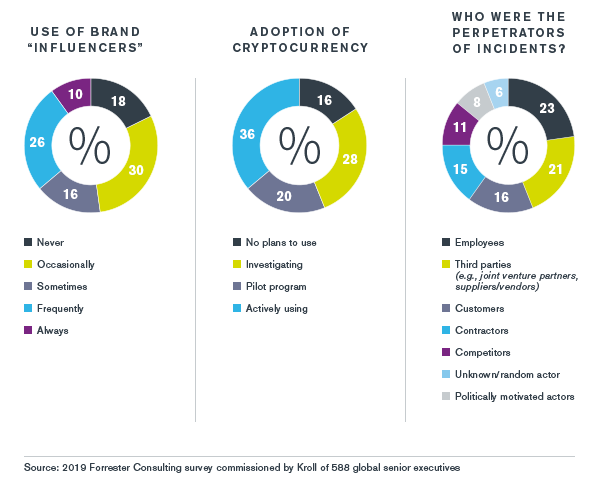

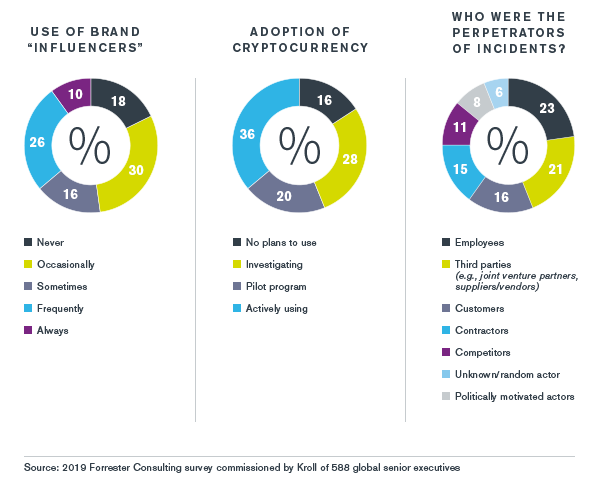

Thirty-six percent of consumer goods respondents—a higher percentage than in any other industry—indicate that their organizations are actively using cryptocurrency (vs. 28 percent for all industries). The industry is expected to continue to be a bellwether for broader crypto adoption.

At a higher rate than any other industry, consumer goods organizations express concern about three possible future risks: large-scale, coordinated cyberattacks (82 percent vs. 68 percent for all industries), a significant financial crisis (78 percent vs. 69 percent for all industries) and political instability (70 percent vs. 63 percent for all industries).

Respondents in the consumer goods industry experience problems predominantly in two key areas of the value chain. The first is reputational damage caused by third-party relationships (34 percent vs. 29 percent for all industries). The second is counterfeiting and gray market activity (26 percent vs. 17 percent for all industries).

Adverse incidents caused by third-party relationships are most often due to issues in the supply chain. Consumers now place a much greater emphasis on the integrity of the supply chain and the ethical standards of the brands whose products they buy. So it is that consumer goods organizations are more likely than those in any other industry to prioritize mitigating against reputational damage caused by third parties (84 percent vs. 73 percent for all industries). However, this concern is not always manifest in practice. While consumer goods companies are more likely than the average of all industries to conduct reputational due diligence on some stakeholders, they are slightly less likely to do so on business partners and suppliers. Given the industry’s branding concerns, reputational due diligence on these two groups should be standard practice.

Counterfeiting and gray market activity remain persistent problems. In our survey, 26 percent of consumer goods companies report experiencing significant counterfeiting incidents within the last 12 months (vs. 17 percent for all industries). Counterfeiting infringements are so frequent that many businesses find they have to be selective in the cases they choose to pursue.

Respondents in the consumer goods industry acknowledge that their companies instill a strong culture of transparency and accountability. A significant majority of respondents say they get a clear message from the top of their organizations that a culture of integrity is important (88 percent vs. 78 percent for all industries), and the proportion who agree that their companies respond to risk management incidents in consistent ways is higher than in any industry besides life sciences (84 percent vs. 75 percent for all industries).

Thirty-six percent of consumer goods respondents—a higher percentage than in any other industry—indicate that their organizations are actively using cryptocurrency (vs. 28 percent for all industries). The industry is expected to continue to be a bellwether for broader crypto adoption.

At a higher rate than any other industry, consumer goods organizations express concern about three possible future risks: large-scale, coordinated cyberattacks (82 percent vs. 68 percent for all industries), a significant financial crisis (78 percent vs. 69 percent for all industries) and political instability (70 percent vs. 63 percent for all industries).