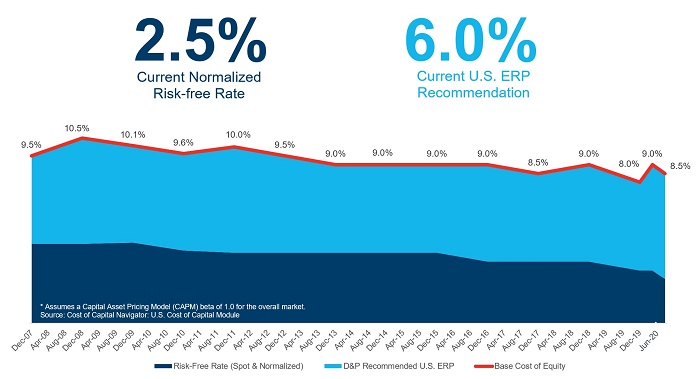

Duff & Phelps regularly reviews fluctuations in global economic and financial market conditions that warrant a reassessment of the Equity Risk Premium (ERP) and accompanying risk-free rate, both key inputs used to calculate the cost of equity capital in the context of the Capital Asset Pricing Model (CAPM) and other models used to develop discount rates.

The outbreak of COVID-19 has generated an unprecedented reaction to a pandemic. While global equity markets have recovered substantially from their March 23 lows—benefiting from unparalleled monetary actions by central banks and fiscal stimulus packages by several governments—many of the benchmark equity indices are still lower relative to the levels achieved in mid-February 2020. Equity volatility has decreased from the record highs reached in March, but remains elevated. U.S. consumer confidence and business optimism recovered slightly, but are still significantly lower than pre-coronavirus, while job losses in several industries (and the unemployment rate) continue to be at historical high levels. Economists have further slashed real economic growth projections for 2020, with the global economy now predicted to suffer a worse contraction than during the 2008-2009 Global Financial Crisis.

Based on current financial market and economic conditions, we are reaffirming the Duff & Phelps recommended U.S. ERP at 6.0% to be used in conjunction with a normalized risk-free rate. However, based on declining estimates of real interest rates and lower long-term growth estimates for the U.S. economy, we are lowering the normalized U.S. risk-free rate from 3.0% to 2.5% when developing discount rates as of June 30, 2020 and thereafter, until further guidance is issued. For similar reasons, the normalized risk-free rates for both CAD- and GBP-denominated discount rates are also being lowered from 3.0% to 2.5% when developing discount rates respectively for Canada and the U.K. as of June 30, 2020 and thereafter, until further guidance is issued.

The decision to reaffirm the U.S. ERP recommendation takes into consideration that despite the improvements seen in financial markets, the degree of uncertainty continues to be particularly high when it comes to assessing the ultimate impact of the economic recession on companies’ earnings and the shape that the recovery will take. In addition, the upcoming U.S. presidential election in November 2020 may introduce even more uncertainty to the economic environment.

The newly concluded normalized U.S. risk-free rate of 2.5%, together with the re-affirmed recommended U.S. ERP of 6.0% implies a base U.S. cost of equity capital of 8.5% (2.5% + 6.0%).

Stay Ahead with Kroll

Valuation Services

When companies require an objective and independent assessment of value, they look to Kroll.

Business Valuation Services

Kroll is the largest independent provider of business valuation services.