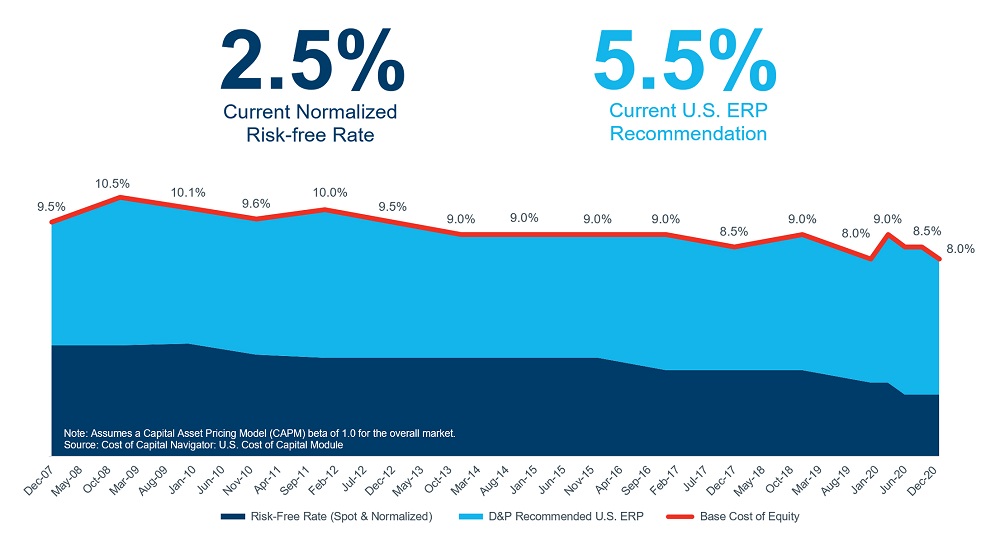

Duff & Phelps Recommended U.S. Equity Risk Premium Decreased from 6.0% to 5.5%, Effective December 9, 2020

The Equity Risk Premium (ERP) is a key input used to calculate the cost of capital within the context of the Capital Asset Pricing Model (CAPM) and other models. Duff & Phelps regularly reviews fluctuations in global economic and financial conditions that warrant periodic reassessments of ERP.

Based on current economic and financial market conditions, Duff & Phelps is lowering its recommended U.S. ERP from 6.0% to 5.5% when developing discount rates beginning on December 9, 2020 and thereafter, until further guidance is issued.

The current ERP recommendation was developed in conjunction with a “normalized” 20-year yield on U.S. government bonds of 2.5% as a proxy for the risk-free rate (Rf), implying an 8.0% (2.5% + 5.5%) “base” U.S. cost of equity capital estimate as of December 9, 2020.

Our new recommendation takes into consideration several recent developments. In the fourth quarter of 2020, U.S. equity markets reached new all-time highs, spurred by optimism about new COVID-19 vaccines and the expectation of continued support by the Fed (including ultra-low interest rates through at least 2023, and possibly longer), coupled with lower uncertainty regarding the impact of the U.S. presidential election on the economy and future corporate earnings. Equity volatility reverted to levels close to long-term averages, and corporate credit spreads have narrowed to historical averages. Consumer confidence and business optimism improved, although the former is still far below the levels observed prior to the outbreak.

On the other hand, there are still a number of risk factors and sources of uncertainty that may impact the shape of the U.S. economic recovery and the pattern of financial markets’ behavior over the next few months. Nominal U.S. gross domestic product (GDP) remains at a lower level than at year-end 2019. Furthermore, in percentage terms, in 2020 real GDP is still expected to experience the worst contraction since World War II. A third wave of COVID-19 cases could lead to a stalling of the recovery, or to another period of economic contraction, as states across the U.S. have already begun (or are considering) a new round of lockdowns until COVID-19 vaccines are more widely available.

Stay Ahead with Kroll

Valuation Services

When companies require an objective and independent assessment of value, they look to Kroll.

Valuation Services

When companies require an objective and independent assessment of value, they look to Kroll.