The extent to which certain legal and financial professionals' services have been misused can be seen through the widely reported leaks of non-public information contained in the Panama and Paradise papers and the various media investigations that have been conducted on the back of those leaks. Recent major money laundering investigations, including the multiple investigations into Nordic banks’ operations in Eastern Europe, provide additional indications as to how often professional services are being misused to help criminals bypass anti-money laundering (AML) and counter financing of terrorism (CFT) controls. Such professional services are typically provided by lawyers, accountants, trust and corporate service providers and other professionals. Considering these developments, the Financial Action Task Force (FATF), national regulators and law enforcement are increasingly focusing on professionals and their role in protecting the financial system from abuse. Another aspect taken into consideration is an increasing international acknowledgement that there are professional service providers who deliberately undermine the financial system and facilitate money laundering.

In July 2018, several national tax enforcement authorities, including those of the U.S., UK, and Australia, announced a joint operational alliance to enhance collaboration and conduct joint operations targeting enablers and facilitators of offshore tax crime and money laundering.1 The U.S.’ most recent AML/CFT National Risk Assessment (NRA) from 2018 acknowledged that criminal organizations actively seek professionals to assist them with the laundering of criminal proceeds.2 The NRA further states that a number of regulators and departments, including the U.S. Department of Justice, have been increasingly focusing on such professional money laundering facilitators, which often include financial industry professionals, accountants, real estate agents, and lawyers. Similarly, the UK’s 2015 and 2017 AML/ CFT NRAs also emphasize that criminals are continuously using professionals who are assisting them launder money, either through neglecting due diligence controls or complicity.3

Since 1997, FATF’s typologies have advised that the ever-increasingly stringent controls implemented by financial institutions have led to proportionately more complex money laundering schemes.4 This feature of the global AML regime has increased criminals’ reliance on the services of legal and financial industry professionals, in pursuit of devising increasingly complex methods to launder criminal proceeds. It is known that such professionals provide a number of services that are susceptible to assisting criminals launder money and legitimize the proceeds of crime, most notably by obscuring company ownership through the creation of complex and non-transparent corporate structures and legal arrangements.

There are a number of jurisdictions around the world where professional services form a significant part of the national economies, in proportion to other sectors. Cyprus is one such jurisdiction and as a growing local financial center, its authorities recognize the way in which this aspect of the economy affects the country’s exposure to money laundering risks.

Challenges for the Sector in Cyprus

On November 30, 2018, Cypriot authorities completed the country’s first AML/CFT NRA, identifying the banking, professional services, and real estate industries as the three most exposed to the risk of laundering proceeds of crime.5

Cyprus’ FATF NRA found that local professional service providers regulated by different institutions, the Cyprus Bar Association, Cyprus Securities and Exchange Commission or Institute of Certified Public Accountants of Cyprus, share a common deficiency in their AML programs—an insufficient assessment of customer risk.6 When the NRA was published in 2018, Cypriot professional service providers demonstrated shortcomings in developing an effective risk-based approach (RBA) for categorizing the level of risk posed by clients. In addition, the commonly inadequate risk categorization was compounded by unsatisfactory procedures for transaction monitoring when reassessing the dynamic risk of clients.

Such shortcomings in the RBAs of professional service providers leave them exposed to a key money laundering vulnerability present in the Cypriot financial system. Cypriot authorities and the U.S. Department of State agree that criminal proceeds generated abroad pose a significantly higher threat to the Cypriot financial system, as opposed to exposure to domestically-generated criminal proceeds. In particular, the 2019 U.S. Department of State International Narcotics Control Strategy Report highlights that organized criminal groups and others allegedly used Cypriot financial institutions to launder the proceeds of Russian and Ukrainian illicit activity. Mainly through circumventing beneficial ownership disclosure requirements, using complex layered corporate entities often created by Cypriot professional service providers.7

Witting and Unwitting Involvement in Money Laundering

There are a number of ways in which criminal abuse of professional services could take place. While the range of susceptible services is ever increasing, conceptually, criminals use professionals to introduce criminal proceeds to the financial system, distance themselves from transactions, and spend laundered funds - essentially, placement, layering, and integration, done on their behalf.

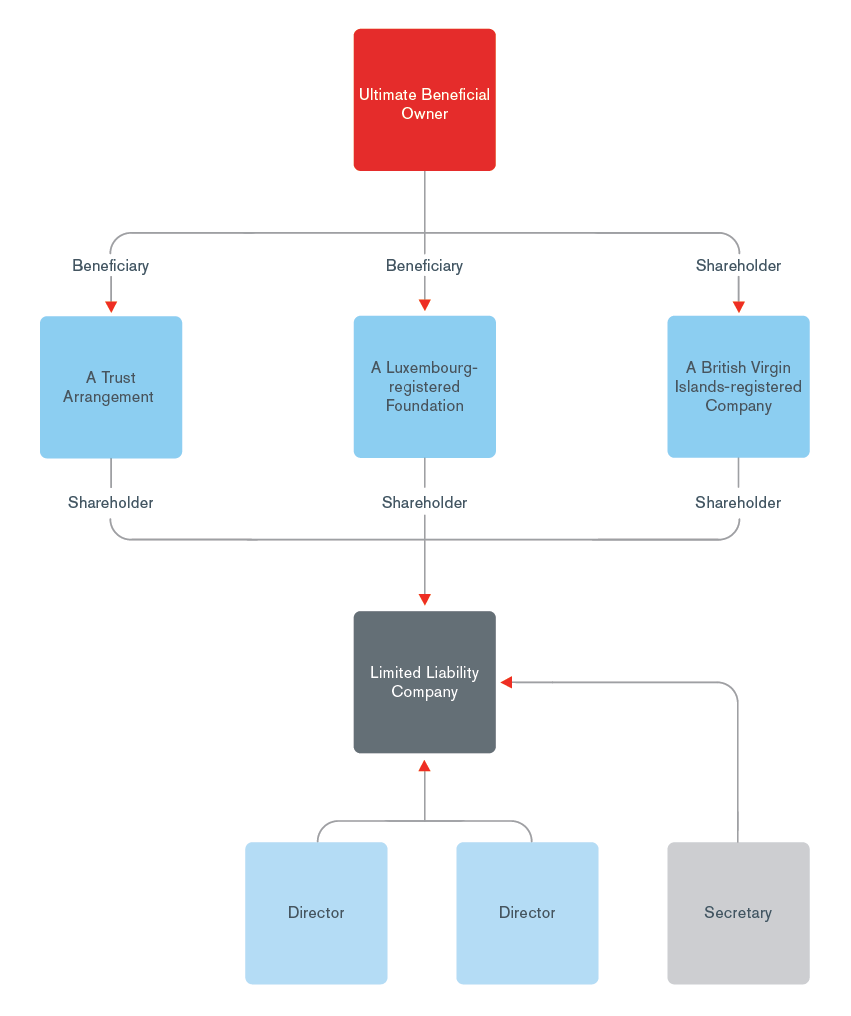

As such, the most vulnerable services are those that allow a professional to act on behalf of their clients, obscuring the clients’ involvement in transactions, company management and ownership of assets. Certain professional service providers can create corporate vehicles and other legal structures, such as trusts and foundations, that can obscure the beneficial ownership of companies, and if abused, can distance a potential criminal or criminal act from the proceeds of a criminal offense.

The chart on the previous page shows a typical structure of a limited liability company: directors, a secretary and an ultimate beneficial owner. While the control structure of such a company can easily be ascertained in some jurisdictions, the chart also demonstrates how certain professional services (in dark blue) can introduce additional layers of ownership that significantly complicate beneficial ownership checks or more complex investigations.

The benefit professional services could provide to criminals is evident. What is more difficult to fully understand are the reasons why professionals become involved in money laundering for their clients.

On the one hand, professionals are at risk of facilitating money laundering unwittingly by neglecting their due diligence controls and not detecting red flags. For instance, an unsatisfactory assessment of risk profiles, as referenced in Cyprus’ 2018 NRA, could result in an inadequate allocation of due diligence resources. A due diligence program with such shortcomings could allocate insufficient resources for screening a high-risk client, inadequately categorized as carrying low levels of risk. The level of due diligence in this case would be inadequate to find red flags or fully comprehend the significance of identified red flags. Ultimately, this scenario could easily result in unwitting involvement in money laundering.

On the other hand, professional service providers may willingly become involved in money laundering, often motivated by profit and competition for clients.8 Service providers working with criminals are gaining access to a market that is otherwise inaccessible to legitimate professionals with adequate due diligence controls. Such deliberate involvement would entail that a professional service provider willfully assists a straw man in a money laundering scheme, after identifying or being aware of red flags. However, there are multiple nuanced levels of involvement within an organization, as also recognized by the FATF and Transparency International.9 Professional service providers could prove reckless by onboarding a client and not asking further questions upon identifying red flags, such as suspicions regarding the client’s identity. A failure to act upon identifying similar red flags and actively seeking high-risk clients, without having proper controls in place, significantly increases the levels of risk an organization is exposed to.

Avoiding Witting and Unwitting Involvement

To conclude, acknowledging that the facilitation of money laundering can occur willingly or unwillingly is the first step that professional service providers can take to protect themselves and the financial system. What comes next is establishing a robust due diligence program that is adequately implemented and resourced. The increasing tendency of criminals to use professionals as an ingredient in complex money laundering schemes, combined with an increasing international regulatory and law enforcement scrutiny, point to a need for professional service providers to take measures to elevate the level of due diligence conducted on their clients.

Acknowledging these needs, in June 2019 the FATF developed guidance for professional service providers on how to implement an RBA that allows a business to distribute resources proportionately to the level of risk.10 Implementing an effective RBA that acknowledges jurisdictional, client, product and service risk requires ascertaining the identities of clients and partners. Doing so to the highest possible standard requires specialized beneficial ownership checks and avoiding a sole reliance on self-reported information, which is often inaccurate or incomplete.

Implementing an RBA and confirming the identity of clients is a regulatory requirement for many industries, such as banking, which are routinely exposed to significant money laundering risks. While banks face challenges of their own, they provide established examples for professional service providers on how to set up and manage due diligence programs aimed at safeguarding their operations and the financial industry as a whole.

Kroll’s Expertise

As a result of Kroll’s recent or ongoing involvement in significant financial crime investigations in Latvia, Ukraine, Cyprus, and Moldova, we have had many opportunities to analyze large amounts of data indicative of current risk trends. These and other similar engagements have allowed Kroll to see and understand the risks to be considered ahead of engaging a client and the regulatory requirements for alleviating such risks. Additionally, Kroll’s cooperation with local regulators in the abovementioned engagements has allowed us to analyze the ways in which criminals misuse professional services to launder money and understand how law enforcement acts against them and those who facilitate such activities in any shape or form. Kroll is able to share these and other relevant insights with clients interested inimproving their approaches to compliance risk assessment or in conducting incident response investigations.

1 Australian Taxation Office, July 4, 2018 (https://www.ato.gov.au/Media-centre /Media-releases/Tax-enforcement-authorities-unite-to-combat-international-tax-crime-and-money-laundering/)

2 US Department of the Treasury, National Money Laundering Risk Assessment 2018, p.30; (https://home.treasury.gov/system/ files/136/2018 NMLRA_12-18 .pdf)

3 HM Treasury, UK National Risk Assessment of Money Laundering and Terrorist Financing 2015, p.68 and HM Treasury National Risk Assessment of Money Laundering and Terrorist Financing 2017, pp.43,49,63

(https://assets.publishing.service.gov.uk/government/uploads/system/uploads /attachment_data /file/468210/UK_NRA_October_2015_final_web.pdf

https://assets.publishing.service.gov.uk /government/uploads/system/uploads/attachment_data /file/655198/National_risk_assessment_of_money_laundering_and_ terrorist_financing_2017_pdf_web.pdf)

4 FATF, Report on Money Laundering Typologies 1997, Report on Money Laundering Typologies 2004, Global Money Laundering & Terrorist Financing Threat Assessment 2010, Money Laundering and Terrorist Financing Vulnerabilities of Legal Professionals 2013 (https://www.fatf-gafi.org/media/fatf/ documents /reports/1997%201998%20ENG.pdf ; https://www.fatf-gafi.org/media/fatf/documents /reports/2003_2004_ML_Typologies_ENG.pdf ; https://www.fatf-gafi.org/media/fatf/documents/reports/Global%20Threat%20assessment.pdf ; https://www.fatf-gafi.org/media/fatf/documents /reports/ML%20and%20TF%20 vulnerabilities%20 legal%20 professionals.pdf)

5 Cyprus National Assessment of Money Laundering and Terrorist Financing Risks October 2018, p.11 (http://mof.gov.cy/assets/modules/wnp/articles/201811/448/docs/ cy_concise_nra.pdf)

6 Cyprus National Assessment of Money Laundering and Terrorist Financing Risks October 2018, pp.97-102 (http://mof.gov.cy/assets/modules/wnp/ articles/201811/448/docs/cy_concise_nra.pdf)

7 US Department of State, International Narcotics Control Strategy Report, Volume II: Money Laundering, March 2019, p.87 (https://www.state.gov/ wp-content/uploads /2019/03/INCSR-Vol-INCSR-Vol.-2-pdf.pdf)

Cyprus National Assessment of Money Laundering and Terrorist Financing Risks October 2018, p.29 (http://mof.gov.cy/assets/modules/wnp/articles/201811/448/docs/ cy_concise_nra.pdf)

8 FATF, Global Money Laundering & Terrorist Financing Threat Assessment, July 2010, p.46 (https://www.fatf-gafi.org/media/fatf/documents/reports/ Global%20Threat%20assessment.pdf)

9 FATF, Money Laundering and Terrorist Financing Vulnerabilities of Legal Professionals, June 2013, p. 5. (http://www.fatf-gafi.org/media/fatf/documents/ reports/ML%20and%20TF%20 vulnerabilities%20 legal%20 professionals.pdf)

Transparency International, At Your Service - Investigating how UK businesses and institutions help corrupt individuals and regimes launder their money and reputations, p.14. (https://www.transparency.org.uk/publications/at-your-service/)

10 FATF, Guidance for a Risk-based Approach: Legal Professionals, Trust and Company Service Providers, and the Accounting Profession, June 2019 (https://www.fatf-gafi.org/ media/fatf/documents/reports/Risk-Based-Approach-Legal-Professionals.pdf; https://www.fatf-gafi.org/media/fatf/documents/reports /RBA-Trust-Company-Service-Providers.pdf; https://www.fatf-gafi.org/media/fatf/documents/reports /RBA-Trust-Company-Service-Providers.pdf ; http://www.fatf-gafi.org/media/fatf/documents/reports/RBA-Accounting-Profession.pdf)

Stay Ahead with Kroll

Background Screening and Due Diligence

Comprehensive spectrum of background checks, screening and due diligence services.

Kroll Compliance Portal

To make effective business decisions at scale, you need a compliance program grounded in objectivity and efficiency. Kroll Compliance Portal is your single platform for managing all aspects of a third-party compliance program.