New Kroll Study Shows Stronger Investment Returns for Companies with High ESG Ratings

Globally, ESG Leaders had annual returns of 12.9% vs. 8.6% for ESG Laggards

New York – Kroll, the leading independent provider of global risk and financial advisory solutions, today announced the launch of its ESG and Global Investor Returns Study, which examines the relationship between historical returns of publicly traded companies and their ESG ratings globally. We analyzed data on over 13,000 companies across a variety of industries around the globe and found that companies with better ESG ratings outperformed their peers with lower ratings.

“The future of ESG and sustainability investing will depend on investor confidence in the reliability of ESG ratings and ESG disclosures and their relevance as an indicator of public company performance,” stated Carla Nunes, Managing Director and Global Leader of the Valuation Digital Services Group at Kroll. “Quantitative analysis of the relationship between ESG ratings and equity returns is a critical component for evaluating ESG-based investment decisions. Increased regulation around ESG ratings is likely to bring some uniformity to the field.”

As new global regulatory and financial reporting standards are set, ESG investing will likely remain an important driver of investment decisions with management teams, investment firms, regulators and standard setters. A strong ESG materiality framework for identifying and assessing dynamic ESG factors is critical for effective reporting. Because the concept of materiality differs between ESG disclosure standards and proposals, there will be an increased need for complex data-gathering processes, which will require technology solutions and a close attention to internal controls.

“The demand for ESG disclosure attestation and assurance services will also increase dramatically, allowing investors to place greater reliance on ESG data for their investment-decision making,” Nunes added.

Key findings from the study include:

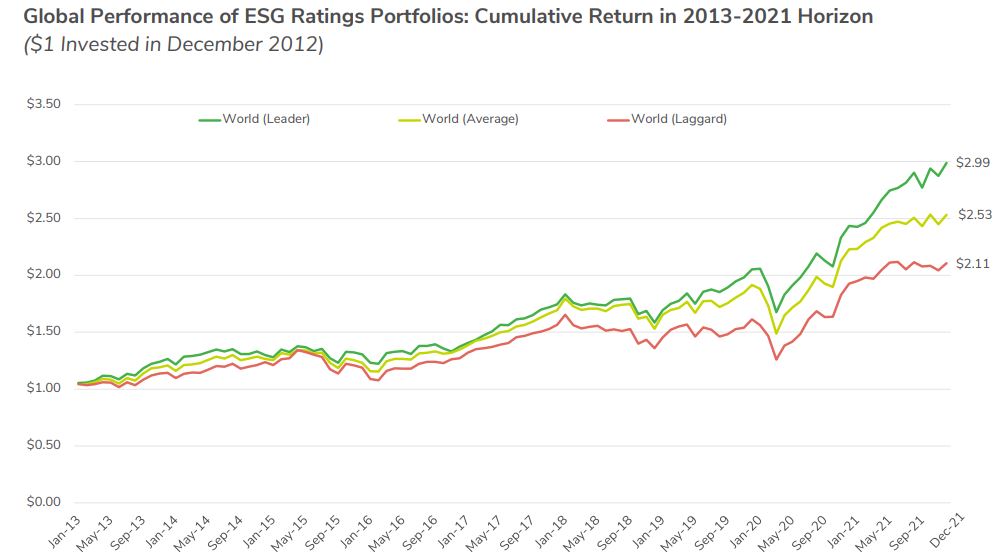

- Globally, ESG Leaders earned an average annual return of 12.9%, compared to an average 8.6% annual return earned by Laggard companies. This represents an approximately 50% premium in terms of relative performance by top-rated ESG companies.

- In the United States, the country with the largest number of rated companies, the ESG Leaders earned an average annual return of 20.3%, compared to a 13.9% average annual return earned by Laggard companies. Similar to the findings globally, the relative performance by top-rated ESG companies was nearly 50% stronger than their lower-rated counterparts.

- The positive relative performance of ESG Leaders vs. Laggards was generally consistent across all major geographic regions and for most industries, with some exceptions.

- European companies are further along in their ESG journey, according to MSCI. For example, in December 2021, nearly a third of Western European companies were rated as ESG Leaders. In contrast, only 10% of North America and 6% of Asia companies had a Leader rating.

- Globally, Leaders outperformed Laggards in all industries analyzed, except for Consumer Staples and Health Care. This contradicts the claim by some market analysts that the outperformance of ESG investments (when present) is attributable to the overweighting of Information Technology stocks.

Kroll noted that the need for a better understanding of the correlation between ESG ratings and investment performance was being driven by the growing volume of sustainable investments globally. In 2020, more than one-third of investment assets in developed markets was defined as “sustainable” – reaching a total of US$35.3 trillion globally and US$17.1 trillion in the US alone, according to the Global Sustainable Investment Alliance. However, accusations of greenwashing have led to significant pushback on what is characterized as “sustainable” investing, spurring regulatory enforcement actions, increased litigation, as well as a flurry of proposed and/or finalized new standards focused on ESG and sustainability disclosures around the globe. As a result, many investment funds have changed their naming or classification and no longer label themselves as sustainability focused. This makes sustainable investing trends very difficult to compare between 2021 and 2022. In addition, according to a BCG analysis, global overall assets under management declined by 9.5%, from US$108.6 trillion in 2021 to US$98.3 trillion in 2022, making comparisons even more complicated.1

Source:

BCG, "Global Asset Management 2023—21st Edition - The Tide Has Turned", May 2023.

Study Methodology

The Kroll ESG and Global Investor Returns Study examines a universe of over 13,000 companies across a variety of geographies and industries around the globe. The study examines the relationship between a company’s total stock returns (dividends plus capital appreciation) over the 2013-2021 period as compared with ESG company ratings published by MSCI to ascertain if an investment strategy focused on companies with a better rating would result in a superior return performance. This study is unique due to its comprehensive nature: the relationship between company ESG ratings and returns covers four geographic regions (World, North America, Western Europe and Asia), 12 countries/markets (Australia, Brazil, Canada, China, France, Germany, Hong Kong Special Administrative Region of the People’s Republic of China (Hong Kong SAR), India, Japan, South Korea, the United Kingdom (UK) and the U.S.) and 11 industries.

About Kroll

As the leading independent provider of risk and financial advisory solutions, Kroll leverages our unique insights, data and technology to help clients stay ahead of complex demands. Kroll’s team of more than 6,500 professionals worldwide continues the firm’s nearly 100-year history of trusted expertise spanning risk, governance, transactions and valuation. Our advanced solutions and intelligence provide clients the foresight they need to create an enduring competitive advantage. At Kroll, our values define who we are and how we partner with clients and communities. Learn more at kroll.com.

For more information, contact:

Devonne Cusi

+1 212 450 8199

[email protected]