Illicit fund flows present a significant risk to global trade. Here’s how they can occur.

Illicit fund flows are estimated to total as much as $1 trillion each year. Large-scale fraud, corruption and money laundering frequently involve the complicated and rapid movement of funds among organizations in multiple countries. While jurisdictions are increasingly collaborating to fight illicit fund flows, each still has its own regulatory and enforcement infrastructure, policies, capabilities and priorities. These differences create gaps that make it possible for sophisticated actors to evade detection. Examples of conditions that can give rise to illicit fund flows include:

- Developing countries with abundant natural resources but weak financial crime controls that are susceptible to the misappropriation of sovereign funds by unscrupulous government officials

- Banks or other financial institutions with insufficient credit or risk assessment procedures that are targeted by organizations seeking to procure capital for unauthorized purposes

- Companies that exercise insufficient oversight of subsidiaries in countries with high levels of illicit activity, making it possible for their local staff to collude with bad actors to circumvent background or security checks

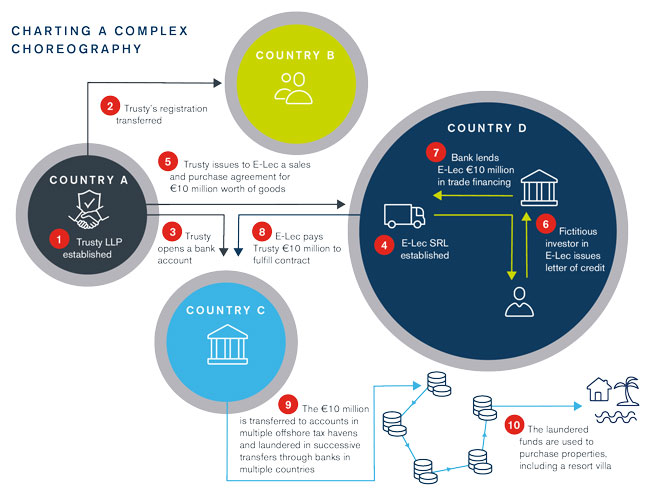

The figure below illustrates a typical illicit fund flow scenario, in which a bank is defrauded of €10 million as a trade financing loan it made is used to buy a resort villa. Many of the vulnerabilities in this scenario can be avoided by having a clear approach to risk management. These steps include:

- Comprehensive due diligence before any potential partnerships are undertaken

- Operationally effective risk assessment policies and procedures

- Regular monitoring of activities in the context of the risks posed—for example, by the activities undertaken or by jurisdictions of operation

- A governance and risk-control framework to provide stakeholders and management with adequate oversight of activities and of the sufficiency of the mitigations that are in place

- Trusty LLP, a limited liability partnership, is established in Country A. Country A has few, if any, requirements regarding transparency of beneficial ownership. The registered address for Trusty is shared by hundreds of companies, yet no active business operates from the premises. The nature of Trusty’s business is broadly stated as “international trade and investment.”

- Once Trusty is established, its registration is transferred to individuals in Country B, a country that also has limited beneficial ownership regulations. This transfer further obscures control of the company.

- Although Country A has few requirements for transparency of ownership when forming LLPs, it has stringent regulations requiring banks to know their customers and monitor transactions for signs of money laundering. To bypass these regulations, Trusty establishes an account at a bank in Country C, a developing nation that does not yet have a sophisticated infrastructure for preventing financial crime; that deficiency makes it difficult for authorities elsewhere to obtain information on account holders if suspicions arise.

- A second company, E-Lec SRL, purporting to be a wholesaler/distributor of electrical fittings, is established in Country D. In reality, E-Lec is inactive and conducts no business.

- A sales and purchase agreement is generated, calling for E-Lec to purchase €10 million worth of electrical fittings from Trusty.

- Ostensibly to purchase those electrical fittings for resale, E-Lec requests trade financing from a commercial bank, also in Country D. The company secures the financing with collateral in the form of a letter of credit, supported by falsified bank statements, from a fictitious E-Lec investor.

- The commercial bank lends €10 million to E-Lec.

- E-Lec wires the €10 million to Trusty’s bank account.

- Those funds are immediately transferred to secondary bank accounts held in multiple offshore tax havens to further obscure the flow of the illicit funds.

- Eventually the funds are used to purchase properties in several countries, including a villa at a beach resort. The loan is in default but cannot be collected, as the individuals behind both Trusty and E-Lec have disappeared.

Forensic Investigations and Intelligence

The Kroll Investigations, Diligence and Compliance team are experts in forensic investigations and intelligence, delivering actionable data and insights that help clients worldwide make critical decisions and mitigate risk.